Flash Entry: Lets understand Energy Fuels' Toliara Feasibility Study

Company making project in one of the poorest and most unstable countries in the world

“I read 318 pages of technical jargon and same remarks over and over again so you don’t have to”. There was actually time in Twitter when copy-paste threads named like that was used to engagement farming. While I never got anything meaningful out of those threads, I hope that this article helps you to understand Energy Fuels’ flagship project little bit better.

This is the most important mining project Energy Fuels have, so if you own the stock or are interested about the company, I highly recommend you to read through this article, or even better, read the full Feasibility Study here. You can also read Base Resources’ Monazite Feasibility Study from December 2023 here. If you don’t care about Energy Fuels but you have a weird fixation that makes you to geek about African mining projects, keep scrolling.

To make this not feel like the actual 318 pages long Feasibility Study file, here is a little rundown and index about the article:

Coup d’etat - October 12, 2025

Permits and legal stuff

Critical Infrastructure

3.1 Infrastructure Summary

Weather

Geology

Economics

6.1 Economics with White Mesa Mill

My remarks and summary of risks

Sections 2-6.1 are mostly imported from the study. I have summarized all the key aspects from the FS and put them into separate sections, so you can get a better understanding of each aspect of the project without having to search them all over the file.

I also decided that I will not mix my opinions with these sections, so you don’t have to guess what is actually coming from the expert and what is coming from the authors pen. You will find my opinions from the last section.

1. Coup d’etat - October 12, 2025

Anyone following the company know, things in Madagascar have recently heated up. That unrest finally culminated to Coup d’etat in October 12, 2025. According to Energy Fuels, first impression of the situation is that the new government is luckily pro-economic development.

The first moves are somewhat promising, as the interim President Michael Randrianirina made his first, and probably most important signing straight from the business world. The new prime minister, Herintsalama Rajaonarivelo, is a businessman and economist who has previously worked for international organisations including the World Bank, European Union and the African Development Bank. The credit insurance group Credendo has argued that the military’s move in appointing Rajaonarivelo could indicate that the junta wants to prioritise tackling the socioeconomic grievances that fed the protests in the first place, realising that without improved conditions Gen Z protests could easily rekindle.

Explaining his choice of Rajaonarivelo as prime minister, the president cited his experience and "connections with the international organisations that work with us".

His first major role will be to create a ‘civilian government’ to serve under Randrianirina and his military committee, made up of officers of the Malagasy army, gendarmerie and police force.

He worked in the private sector before becoming Prime Minister. He is an entrepreneur, consultant and business leader who has served, among other things, as Chairman of the Board of Directors of BNI Madagascar, one of the largest banks in Madagascar, President of the International Trade Council of Madagascar (ITBM), and President of the Federation of Entrepreneurs of Madagascar, FIVMPAMA.

Junta showed even more uncharacteristic behaviour, as three prominent opponents of former President Andry Rajoelina’s regime appointed to key ministerial posts. The new government’s priorities include fighting impunity, enforcing budgetary austerity, and creating a stable business climate, interim President Michael Randrianirina said at the ceremony.

In Madagascar’s case, at least the first impression is that the new government have started with some sensible decisions, but the situation is definitely worth monitoring as it continues to evolve. Energy Fuels is in the middle of a process of acquiring a monazite exploiting permit to the current licence, so the company get to do business with this new government straight away.

2. Permits and legal stuff

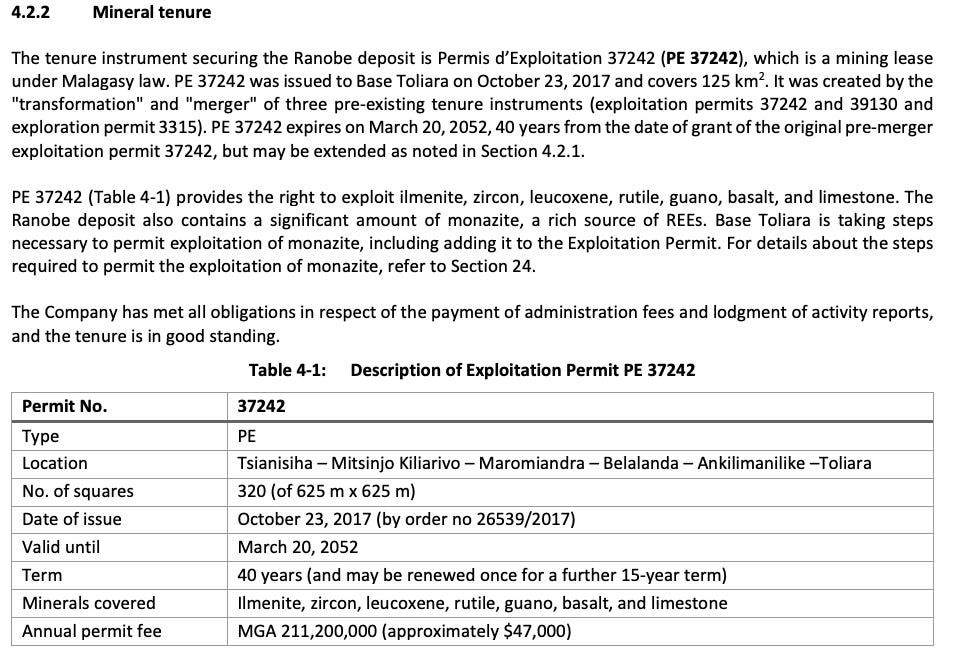

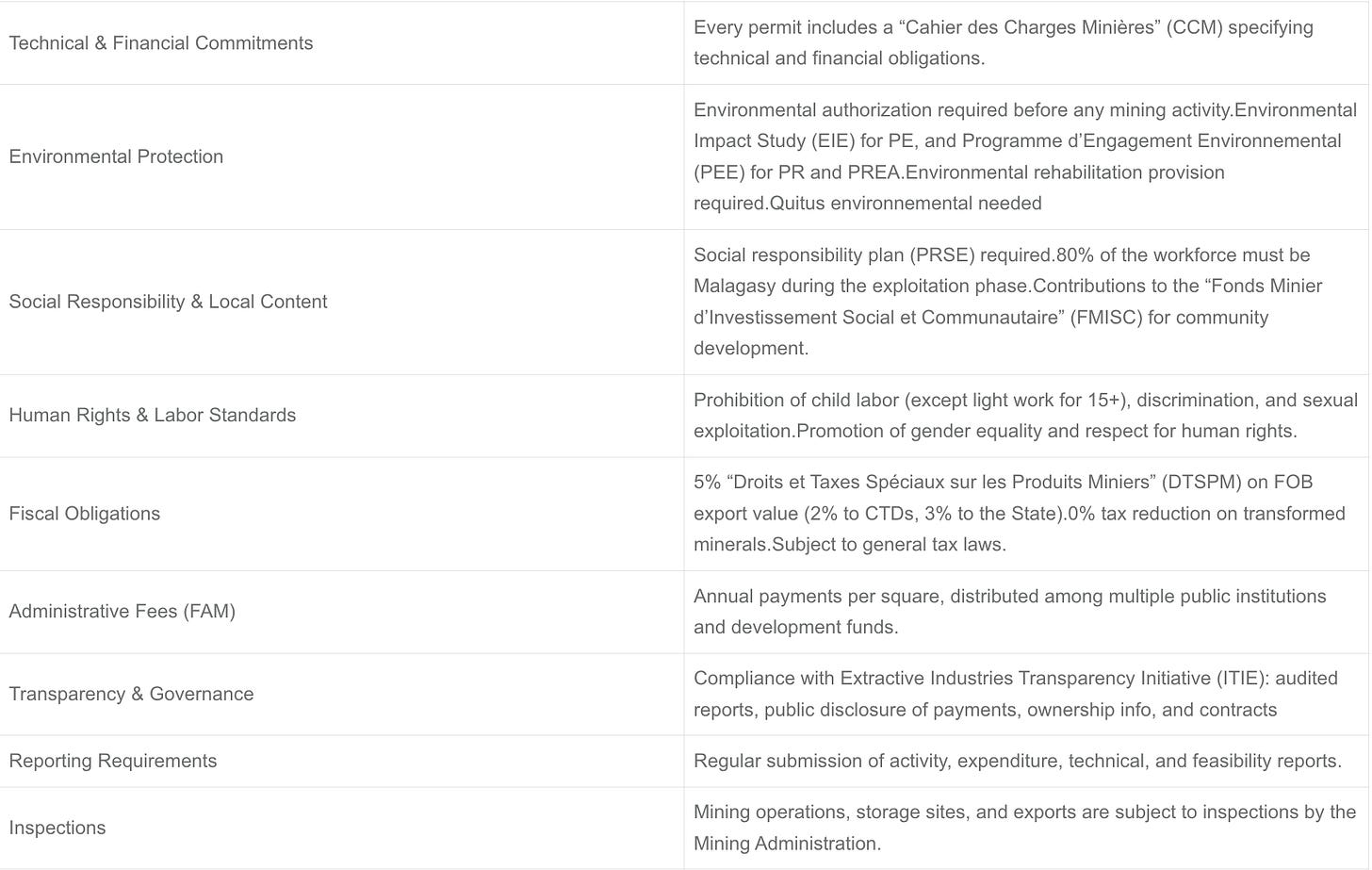

Energy Fuels currently holds Exploitation Permit 37242. A PE usually covers up to five mineral substances, but this can be extended to a maximum of ten if new resources are discovered. In such cases, the company must update its mining plan and submit additional environmental documents for approval. Energy Fuels does not have yet a permit to exploit monazite.

Next steps to add monazite into Exploitation Permit 37242

Tripartite agreement to be entered with the Institut National des Sciences et Techniques Nucléaires and the Office des Mines Nationales et des Industries Stratégiques (OMNIS). This agreement sets out measures and instructions relating to radioprotection, including the permit holder’s commitment to comply with Malagasy laws and regulations with respect to radioprotection and management of radioactive waste and with International Atomic Energy Agency regulations

Bipartite agreement to be entered with OMNIS. This agreement sets out the duration, rights, and obligations of the parties, work phases, use and transfer of all exploration and operational data and terms and conditions for termination

Approval of the Autorité Nationale de Protection et de Sûreté Radiologiques de Madagascar (National Authority for Radiation Protection and Safety) of the proposed radioactive activities.

The company have further stated:

Some aspects of the above steps need clarification and the Company has been working with Government to obtain the necessary clarity. In particular, as between relevant statutory instruments, it is not clear whether an Updated ESIA and updated environmental permitting are required before monazite can be added to PE 37242 or whether these can occur after PE 37242 is extended to include monazite. In either case, an Updated ESIA and updated environmental permitting are required before any exploitation of monazite.

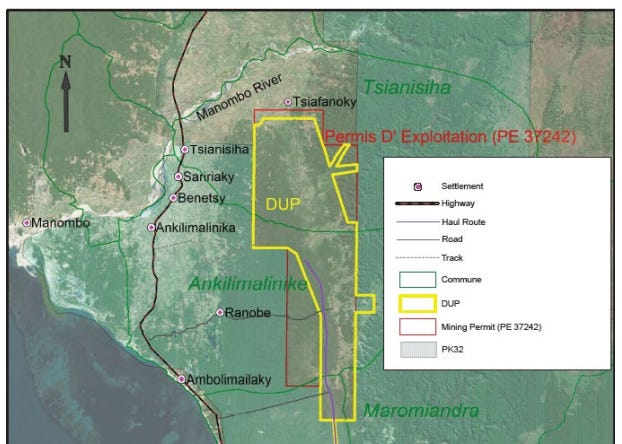

Additionally, to develop the project, Energy Fuels proposes securing access to 9,947.5 ha of land parcels, comprising 9,559 ha within PE 37242 and the balance for the project infrastructure, such as the mineral haulage corridor and export facility.

Energy Fuels currently holds 125,000 ha of land in PE 37242. Generally, the land is uninhabited and used primarily for grazing and charcoal production. Existing land tenure varies over the proposed project footprint, with registered titles existing south of the Fiherenana River and north of the river primarily consisting of untilted lands over which customary occupation rights are held (including PE 37242). It is believed that there are only 23 land parcels that have an existing formal land title. These are either situation along the proposed mineral haulage corridor or on the site of the proposed export facility.

Energy Fuels intends to seek private treaty arrangements directly with landowners and holders of customary occupation rights to vest titled land in the Government and extinguish the rights of holders of customary occupation rights for untitled land. As a backup, a declaration of public utility process (referred to as DUP) may be undertaken. DUP is a compulsory acquisition process under Malagasy law and would provide a backstop where private treaty negotiations are unsuccessful. DUP can be applied to both land that is titled and land where customary occupation rights exist. I personally really hope that the company can secure the missing part of the land package via private treaties. Taking the land forcefully would almost certainly result into some kind of opposition in the area.

Environmentally, the project is in close proximity and within the sensitive area, that requires implementation and monitoring of control mitigations to manage the risk and impacts to the protected area. Mitigations identified during the ESIA process will be incorporated into the ESMS documentation, including the construction and operational environmental and social management plans and will be monitored through the project’s environmental and social monitoring programs.

Key points about environmental setting near Toliara project:

Cultural heritage significance (tombs, sacred trees, archaeological sites)

Critically Endangered Madagascar Spiny Thicket Ecoregion

Critically Endangered species in the area

Within Ranobe PK32 protected area

Risk to the project is the presence of endangered species within the project area. The presence of the Critically Endangered Belalanda Chameleon Fucifer belalandaensis habitat in close proximity to the mineral haulage corridor may affect the alignment of the corridor. A Species Action Plan will be developed to define measures for mitigating impacts of the corridor’s construction, and operation on the species. The plan will also explore opportunities to enhance conservation outcomes through research, conservation programs, and species protection initiatives.

Sites of cultural heritage significance have been identified within the mine lease and the haulage corridor wayleave. These include tombs, sacred trees, cultural heritage sites, and archaeological sites. A cultural heritage and archaeological specialist study and associated Cultural Heritage Management Plan will identify and confirm the sites of cultural heritage significance and present the mitigation controls for managing these sites. The RAP will detail the process of relocation of tombs within the mine lease and haulage corridor.

Land within the mine site is primarily utilized for grazing and collection of natural resources by households residing outside of the mine site. A Resettlement Action Plan (RAP) will be developed consistent with the requirements of IFC Performance Standard 5 and will detail the process for resettlement of households that will be displaced through the surface rights acquisition process.

An updated ESIA (ESIA Update) is being prepared to address project changes and new regulatory requirements, and to update environmental and social baseline conditions. This is being conducted in accordance with national requirements and international best practice standards and supported by a suite of environmental and social specialist studies to be undertaken by various national and international subject matter specialists. Permits and regulatory compliance haulage operations will comply with Malagasy road laws, axle limits, and permit requirements. Agreements with local authorities will govern haul route access and safety protocols.

Apart from updated ESIA, permitting for the project is well progressed with Exploitation Permit PE 37232 and Environmental Permit N°55-15-MEEMF/ONE/DG/PE having already been obtained.

The management of radiation risk is a mature and established process, having been successfully implemented on a global scale for many decades. The Toliara Project will benefit from Energy Fuel’s extensive experience in managing radiation risks and impacts at its operations in the United States of America. While radiation exposure risk to employees is inherently low, the Company is committed to implementing all practicable measures to further mitigate risk and minimize radiation exposure to the fullest extent practicable. The Radiation Management Plan and associated operational and environmental monitoring programs will be informed by international best practice and good international industry standards

Since taking ownership of the Toliara Project, considerable community and stakeholder engagement has been done, particularly with affected communities at the village level. This relationship is important to managing the acceptance of all phases of activities, from exploration through to operations.

This engagement includes:

Health sector

Education programs

Community infrastructure

Livelihood enhancement projects.

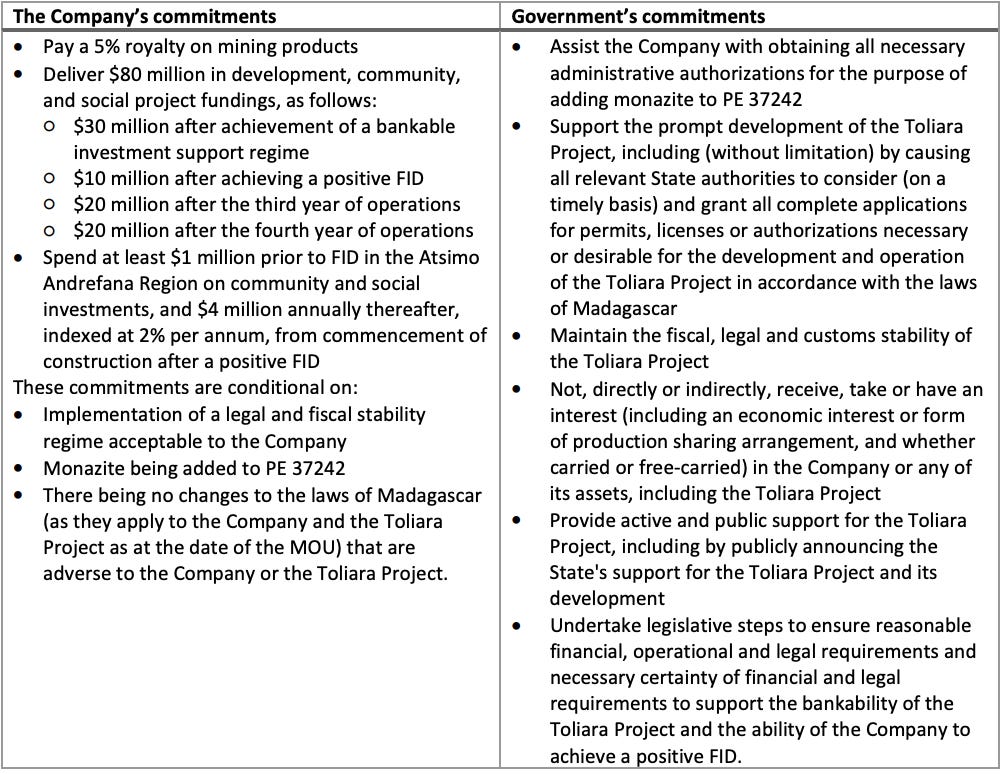

On December 5, 2024, Energy Fuels entered a MOU with the Government outlining key fiscal terms applicable to the project, including development, community, and social project funding. Entry of the MOU was the culmination of extensive negotiations with the Government and represented a major step forward in advancing the project. Establishing an Investment Support Regime is a pre-requisite to Final Investment Decision (FID)

3. Critical Infrastructure

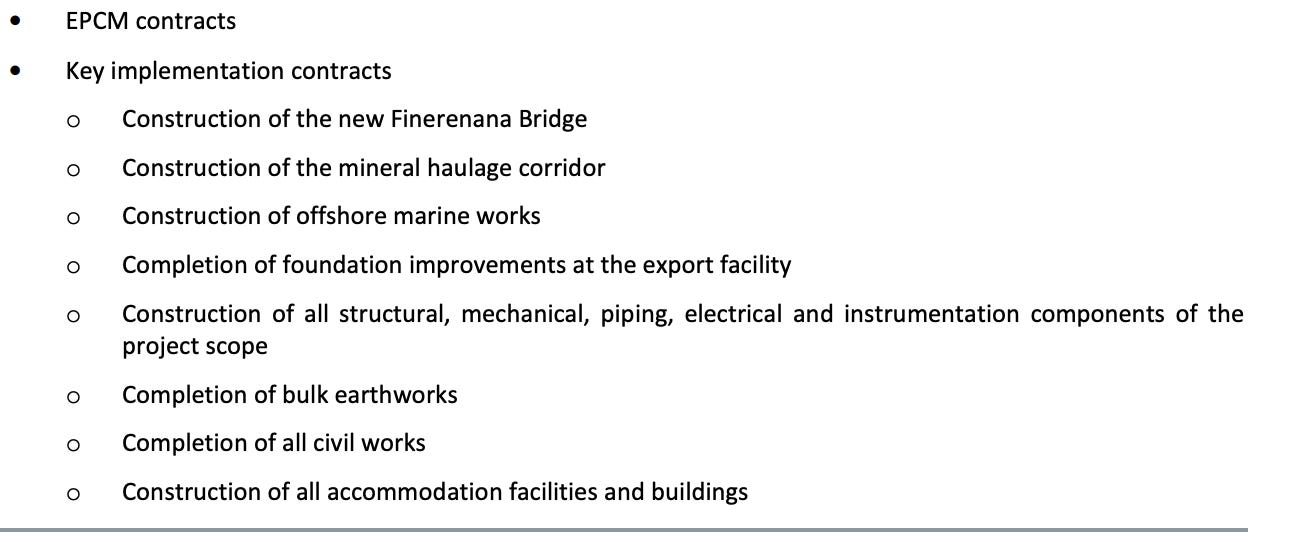

The development of the Toliara Project will require infrastructure to support mining, mineral processing, and product haulage and shipment. Temporary infrastructure, including fly camps, causeway bypasses, and road upgrades, will support early construction activities. Due to a local shortage of construction expertise, Energy Fuels anticipates recruiting personnel from other regions of Madagascar to support implementation activities. Construction employees from outside the Toliara region will be housed on the mine site on a FIFO (Fly-in, Fly-out) basis.

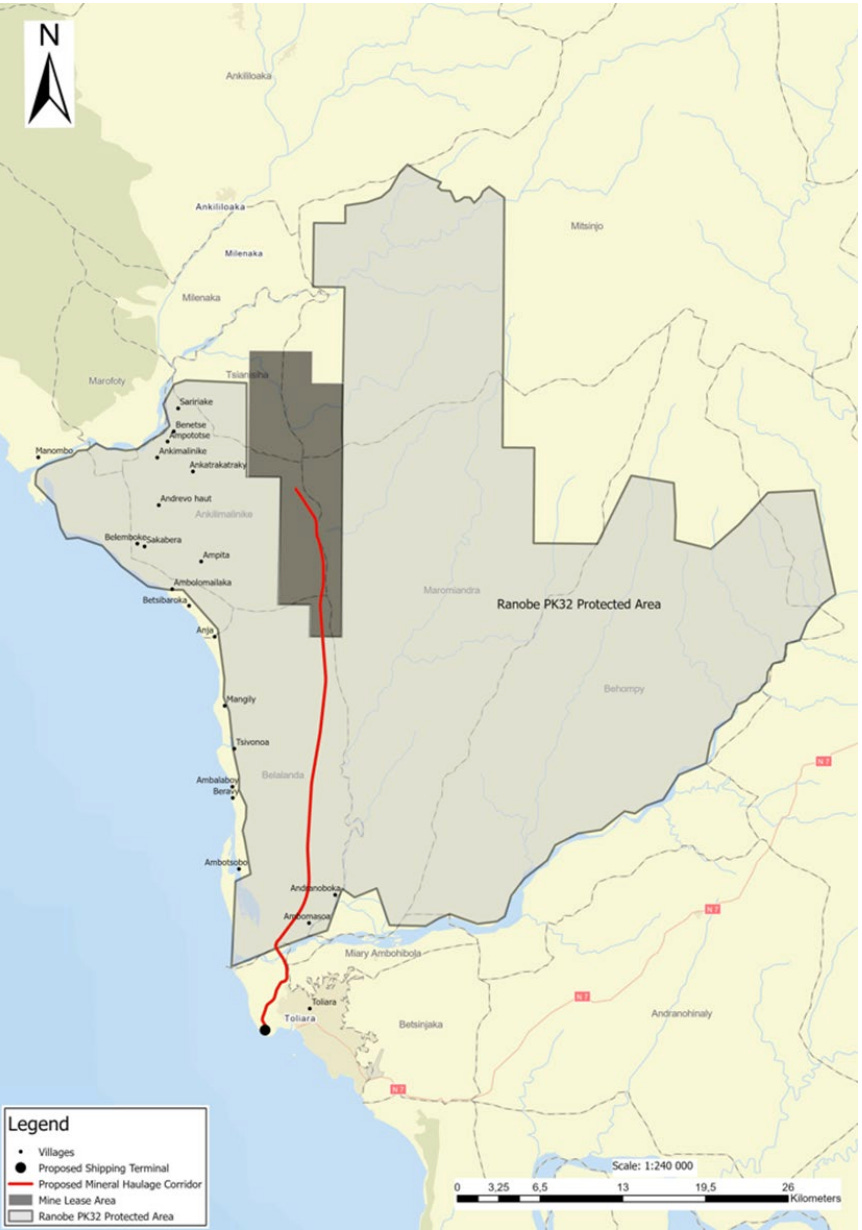

Extensive infrastructure will be required to support mining and processing activities, ranging from earthworks and drainage to plant roads, offices, workshops, equipment stores, product stores, laboratories, and messing facilities. As all products are expected to be exported, secure and safe transport from the Ranobe mine site to the point of loading on ocean-going vessels will be required. The existing port at Toliara is unsuitable for the Toliara Project’s anticipated export requirements. Furthermore, the available onshore port warehousing space is inadequate for the Toliara Project’s expected storage requirements, and it would not be possible for product haulage road trains to navigate Toliara’s crowded and narrow roads. The minimum design criteria for all roads are based on AASHTO standards, with the mineral haulage corridor designed for speeds up to 80 km/h and access roads for 60 km/h. The mineral haulage corridor includes 3.5 m wide lanes with 0.75 m shoulders in each direction and adheres to geometric and vertical alignment parameters optimized for safe haulage.

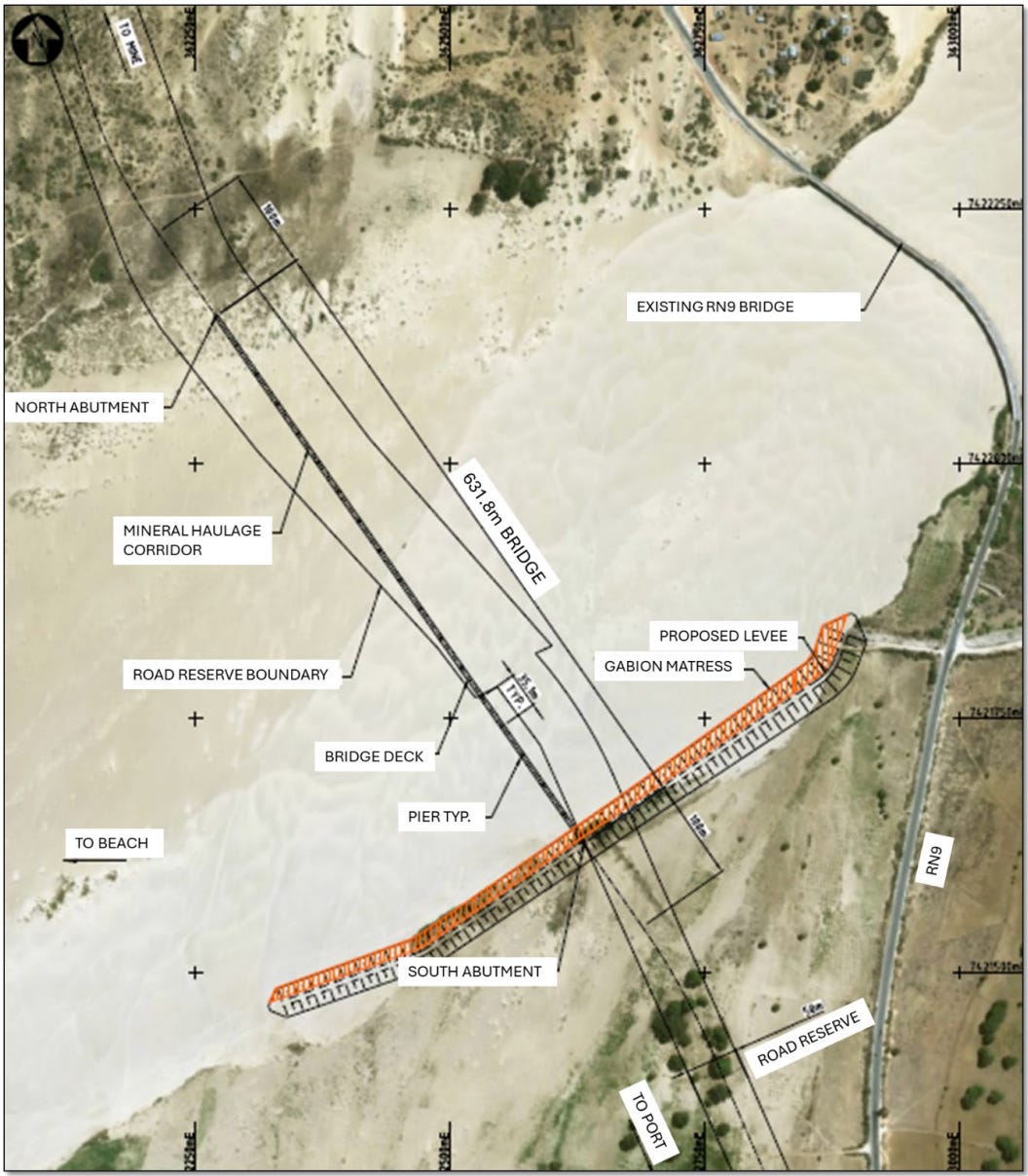

The existing bridge linking the Port of Toliara to the project site is not capable of supporting the project loads greater than 15 t. Consequently, a new bridge will be constructed across the river downstream of the existing bridge. As an interim solution during the construction of the new bridge, a rubble mound bypass will be developed as a causeway to support the project’s logistical requirements. To make things more challenging, subgrade material near the Fiherenana River is predominantly deep alluvium with soft layers, presenting engineering challenges for the bridge structure.

A new export facility on the northern edge of Toliara, at Batterie Beach, forms part of the Toliara Project’s infrastructure requirements. The export facility is 45 km from the mine site and will be connected by a new haul road and bridge across the Fiherenana River. There is an existing airport at Toliara with regular scheduled flights to Antananarivo and Mauritius via Saint Denis, Reunion. The airport has a sealed runway of adequate length to accept Boeing 737 aircraft and equivalents. As road transport between Toliara and Antananarivo is not advised, FIFO personnel movements will be by air.

There is limited existing infrastructure, including substandard roads and bridges, which underscores the need for comprehensive development of roads, transport systems, and port facilities to support large-scale mining and export. Essential services such as water supply, sewage treatment, power generation, communications, security, fuel supply, and waste disposal are integral components of the Toliara Project's infrastructure.

The northern village is the principal accommodation hub and is located approximately 530 m south of the MSP. It is designed to house up to 750 personnel during the peak construction period and will be delivered in four sequential construction phases. Once the project transitions into steady-state operations, occupancy will reduce to approximately 300 operational staff and core personnel. All buildings are designed to be modular, durable, and compliant with regional climate resilience standards, ensuring comfort and safety for occupants under extreme weather events.

In the port, the new export facility, located at Batterie Beach near Toliara, will include two large bulk product storage sheds and a dedicated containerized monazite storage yard. The facility will support shiploading rates for ilmenite, rutile, and zircon of 14 to 17 vessels per year during Stage 1, increasing to 20 to 26 vessels during peak Stage 2 production. Monazite shipping will occur in batches of 200 containers, approximately six to seven times per year. Product storage capacity at the export facility has been optimized to align with sales volumes, parcel sizes, ship frequency, and contingency for weather or shipping delays. Combined storage at the MSP and export facility allows for up to four weeks of production plus the full shipping parcel.

The Batterie Beach site is underlain by loose silty sands and soft clays, unsuitable for supporting heavy structures without improvement.

Infrastructure Summary

All products from the process plants are intended for export. Secure and efficient transport from the Ranobe mine site to ocean-going vessels is critical. The existing port at Toliara is inadequate for this purpose due to its shallow 7 m draft, limited space for bulk storage, and narrow urban roads unsuitable for road trains. To address this, a new export facility will be developed at Batterie Beach, on the northern edge of Toliara. This facility, located 45 km from the MSP, will be linked to the mine site via a purpose-built mineral haulage corridor and a new bridge across the Fiherenana River. Due to the limited availability of skilled construction labor in the Toliara region, a substantial portion of the workforce will need to be sourced from other regions of Madagascar or overseas. These personnel will operate on a FIFO basis. To accommodate them, an accommodation village will be developed near the MSP in the north, while a separate construction camp will be established near the export facility in the south. Toliara has an existing airport with regular commercial flights to Antananarivo. However, current commercial flights are not reliable, and dedicated project charters will be investigated if the current commercial flights’ performance proves to introduce schedule risk to the project. The runway at Toliara is sealed and capable of accommodating Boeing 737-class aircraft, making it suitable for FIFO travel, as road transport between Toliara and Antananarivo is not recommended. International flights to Antananarivo operate from various major international cities, including Paris, Dubai, and Johannesburg.

Also, there are no existing utilities (power, fuel, water, waste treatment) or services (communications, transport, accommodation) that the Toliara Project can draw from in the area. These utilities and services must be established as a component of the Toliara Project in conjunction with the construction of plant and infrastructure.

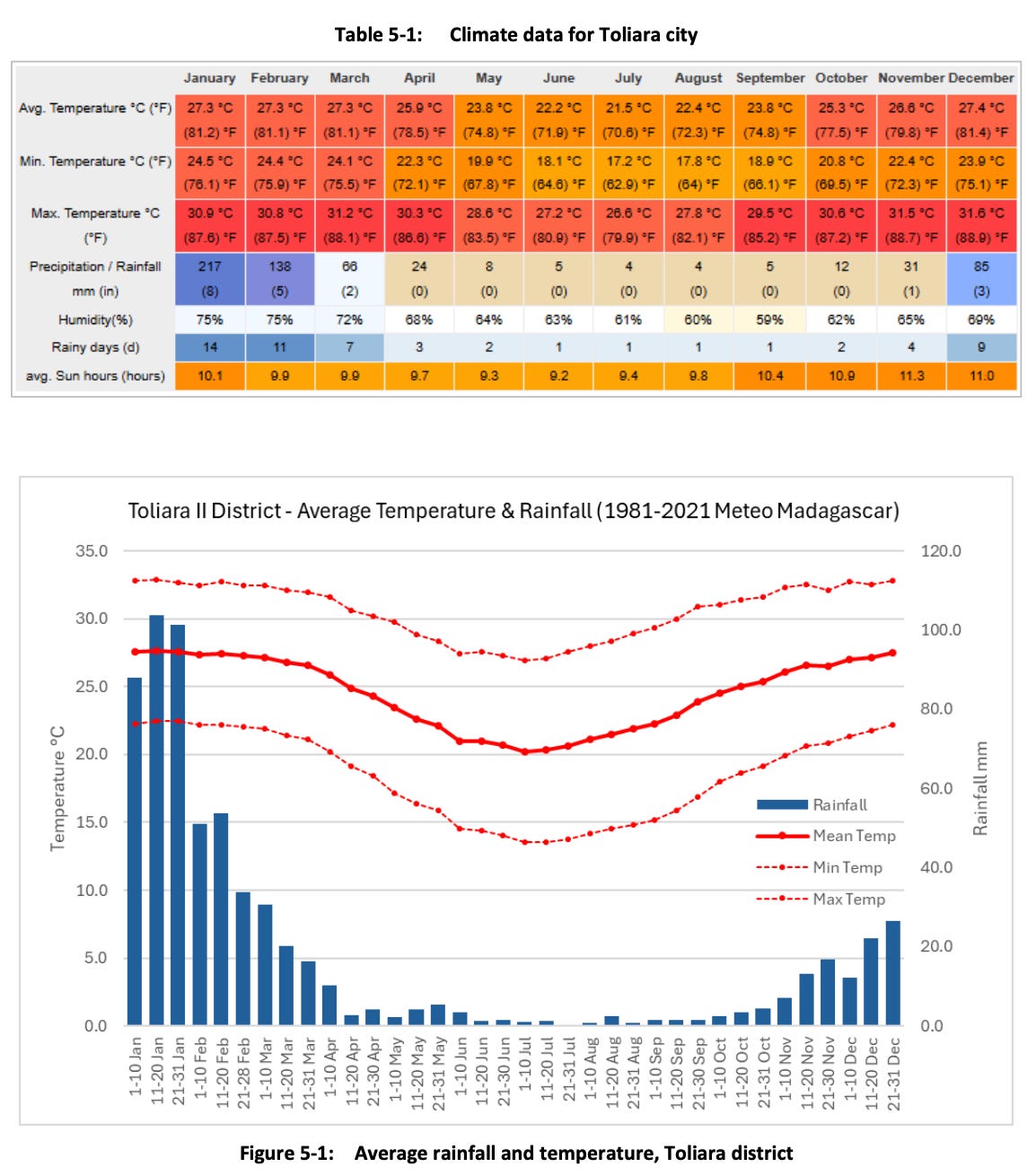

4. Weather

Weather proposes a real risk in Madagascar, as the country has a cyclone season that runs from December to April, with strong winds, heavy rainfall, and storm surges causing flooding, landslides, displacements, and crop and livestock destruction in the area of landfall. Since 2000, 47 tropical storms and cyclones have made landfall in Madagascar, with the east coast of Madagascar having the highest frequency and impact. The Toliara district typically experiences flooding from high rainfall in the hinterland related to cyclones dissipating upon hitting the east coast, or strong winds and localized flooding from cyclones passing through the Mozambique Channel, with very limited direct landfall events. Field operations are best undertaken during the cooler months (April to October), as conditions can be draining due to the high temperatures and humidity experienced during the summer. However, operations can readily occur year-round with appropriate precautions, although minor disruptions could occur due to tropical cyclone events during summer. The Tropic of Capricorn lies just south of Toliara city.

The water table is significantly below the mining base, so any inflows into the mining pit working area should be the result of seasonal rain and run-off. A flood mitigation drain is required as there is a risk that DMU1 could become flooded. The drain will allow flood water to exit the mined void at a level of 110 m. Mine scheduling ensures that DMU1 is not situated below this level during wet seasons. Historical rainfall data shows that heavy rainfall events may occur from December to March, so during this period, the DMU will mine in areas where the pit floor is higher than 110 m.

A series of navigation simulation studies confirmed the feasibility of operating bulk carriers and container vessels at the proposed MBM facility in Toliara. These included a Full Mission Bridge simulation at SAMTRA and a 2D desktop simulation by PRDW using SimFlex4. The Full Mission Bridge study, with 32 real-time runs, validated safe operations for Handymax and Panamax vessels under wind speeds up to 10 m/s and tidal currents of 0.6 m/s. while the desktop simulation evaluated Handysize vessel performance under transverse winds up to 12 m/s. Both studies confirmed that the navigation layout, turning basin, and aids to navigation are adequate for safe vessel operations within defined environmental limits.

Dynamic mooring studies found the berth suitable year-round for bulk carriers and seasonal for container ships. Ballast conditions showed more sensitivity to wind and waves. Operational planning around tides is required for monazite shipments.

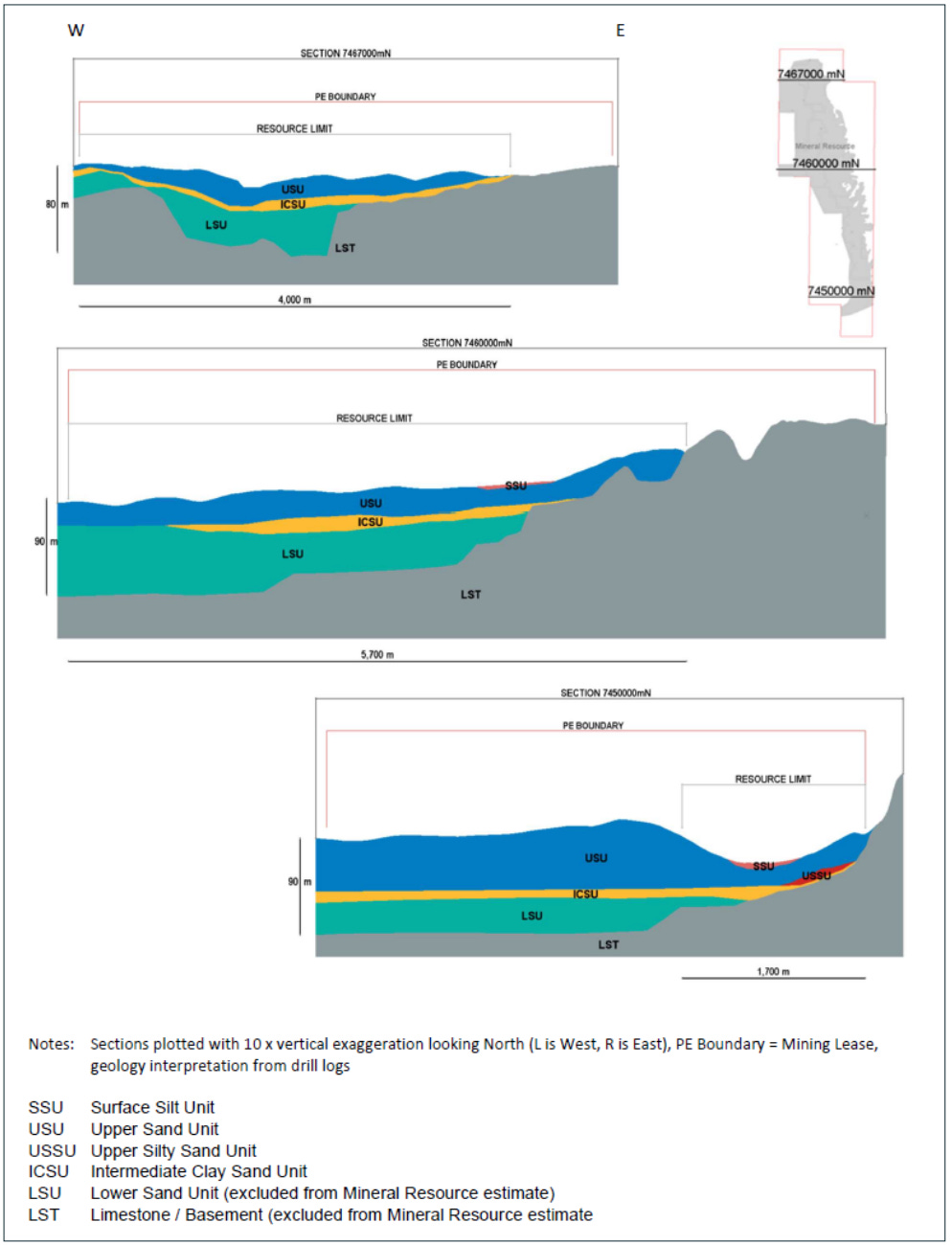

5. Geology

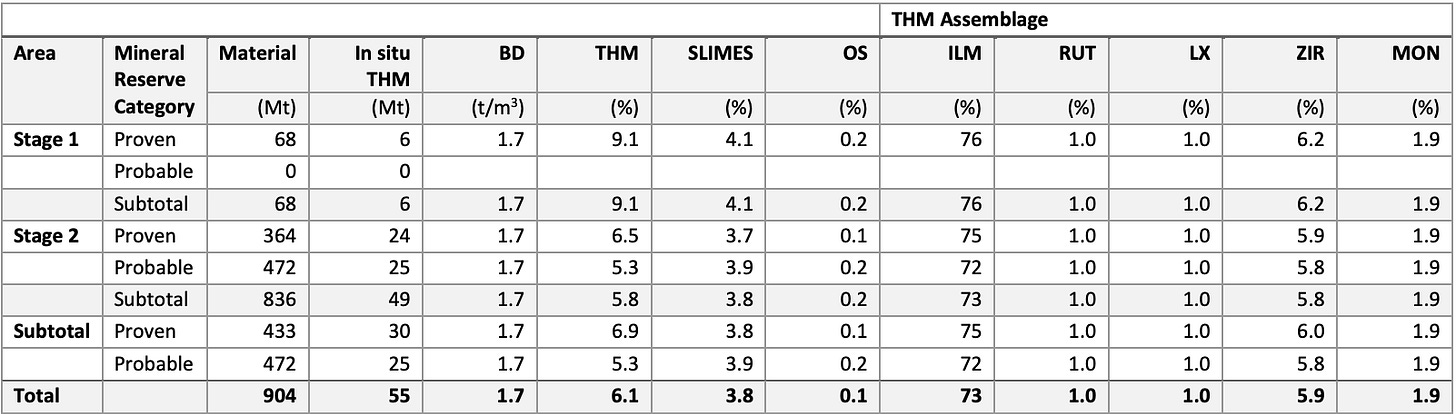

Toliara project contains a massive deposit with 38-year mine life. Some further exploration upside remains, but right now we are going with these numbers.

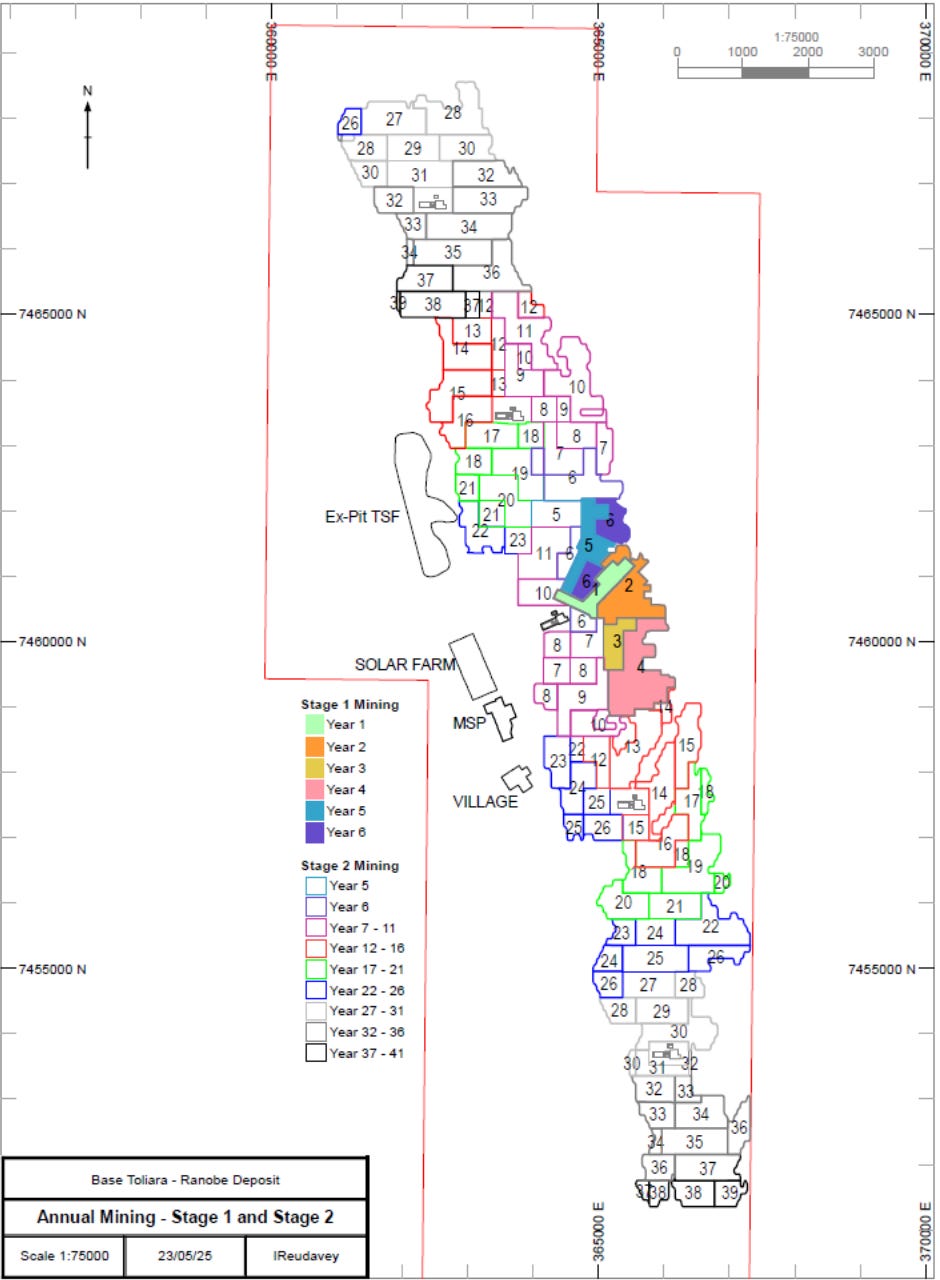

The operating philosophy will be owner-operator at all stages of the mining operations. The Mineral Reserve is a shallow lying deposit with no overburden present and will therefore employ an open pit mining methodology. Operations will run year-round (365 days per year, 24 hours per day) on 12-hour shifts.

The pit walls will be stable as there are no indurated or clay layers within the upper sand unit that could cause over-steepening or allow development of planes of weakness for mass slope failure.

The LSU does not currently form part of the Mineral Resource estimate and presents potential for considerable opportunity to expand the resource in the future. This deposit model has the potential to be repeated along the south-west coastline of Madagascar and provides potential for exploration opportunities.

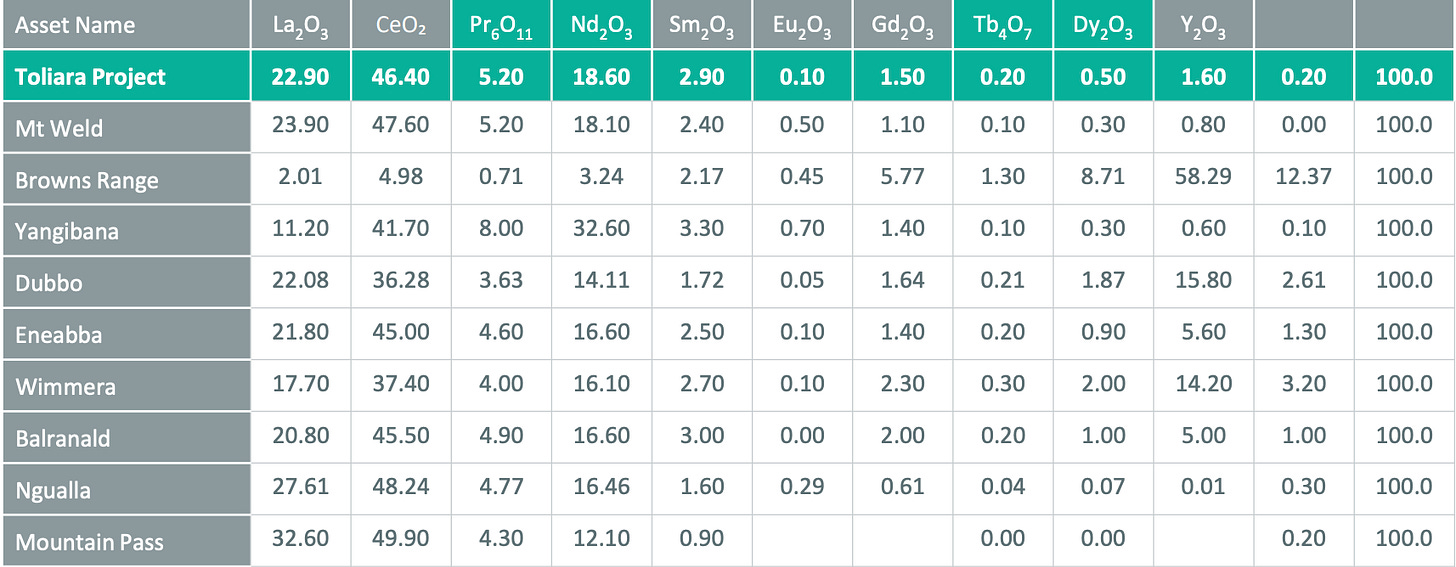

Distribution of Elemental Oxides

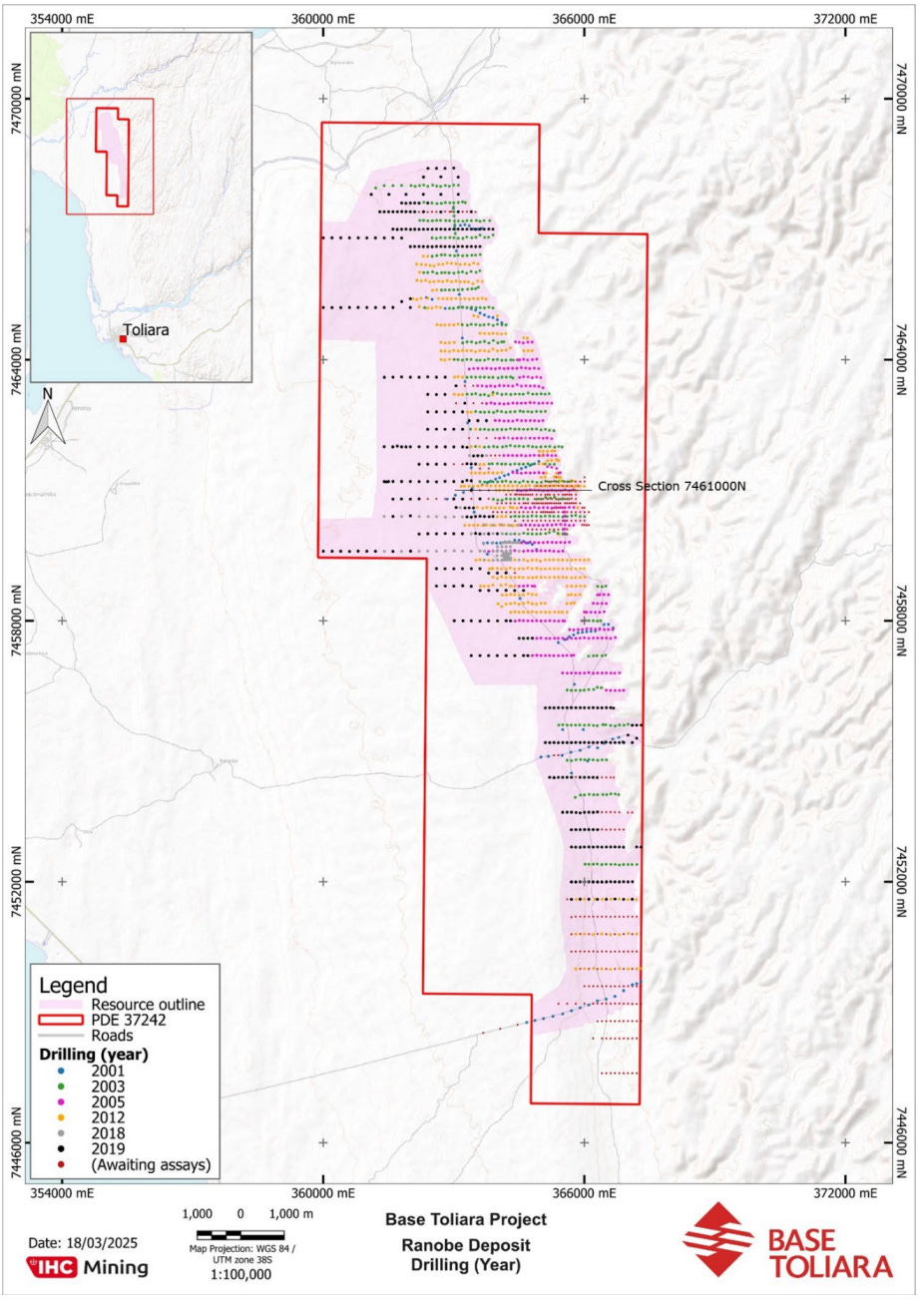

The project represents a well-studied dunal HM sands deposit with significant economic potential, underpinned by decades of exploration and evolving resource assessments. The Ranobe deposit has been systematically explored through multiple drilling programs, which have progressively enhanced the understanding of its mineralogical composition and distribution. The deposit’s high ilmenite content, along with valuable by-products such as rutile, zircon, and monazite, underscores its strategic importance. Although not part of the current Mineral Reserve estimate, there are some gaps in geological knowledge, with respect to the ICSU and LSU grades, mineralogical variability, and lithological controls. Investigating, addressing, and evaluating these gaps will allow for the full realization of the deposit potential.

As a part of future deposit studies, enhanced exploration techniques and interdisciplinary studies will be focused to address these ICSU and LSU knowledge gaps. Increasing drilling density, refining mineralogical analyses, and integrating advanced geophysical and stratigraphic modelling will provide greater confidence in resource estimates and support optimal extraction strategies. By prioritizing a deeper geological understanding, the Toliara Project can maximize its resource utilization, mitigate risks, and ensure long-term viability. The Lower Sand Unit represents a massive exploration target (1,200–1,600 Mt at 8–10% THM, potentially 127–135 Mt contained THM.

In particular, the southern third of the deposit would benefit from further mineral assemblage composite work to understand mineral assemblage variability. Also, deeper drilling in recent campaigns encountered issues such as groundwater in the LSU and swelling clays in the ICSU, underscoring that there is some geological complexity within the deposit that requires definition.

The report’s assumption of uniformity ignores how groundwater and swelling clays terminated many drill holes, creating blind spots in deeper zones.

Some comments from QP (Third Party). QP, Greg Jones is Principal Advisor in Geology and Mining at IHC Mining,

Mr Jones has over 25 years’ experience primarily as a mineral sands Geologist. Most of his career he has been with Iluka Resources $ILU in senior resource estimation/management roles and in the capacity of Competent Person for the reporting and management of Mineral Resources and Ore Reserves.

Historical resource estimates focused on the USU unit, although the 2018 resource estimate update incorporated the ICSU and established the potential of LSU material. For this resource estimate update, the USU and ICSU have been included as a Mineral Resource, but the LSU remains as an Exploration Target. The resource estimate has also been reported within interpreted geological domains to allow for greater transparency, as the mineralization displays different characteristics between domains. The basis for incorporating multiple domains in the resource estimate has been as follows:

Base Toliara has investigated the entire mineralized sequence at Ranobe for development and has completed drilling programs to achieve this outcome. Additional drilling programs are planned in 2026 to continue to assess mineralization, particularly higher grade and shallower portions of the LSU. Field observations and mineralogical assessment show that the LSU has a variable mineral assemblage with elevated levels of garnet and other trash HM relative to the USU. The LSU will not be reported as a Mineral Resource until mineralogy and test work that demonstrates acceptable recovery and product quality has been completed.

6. Economics

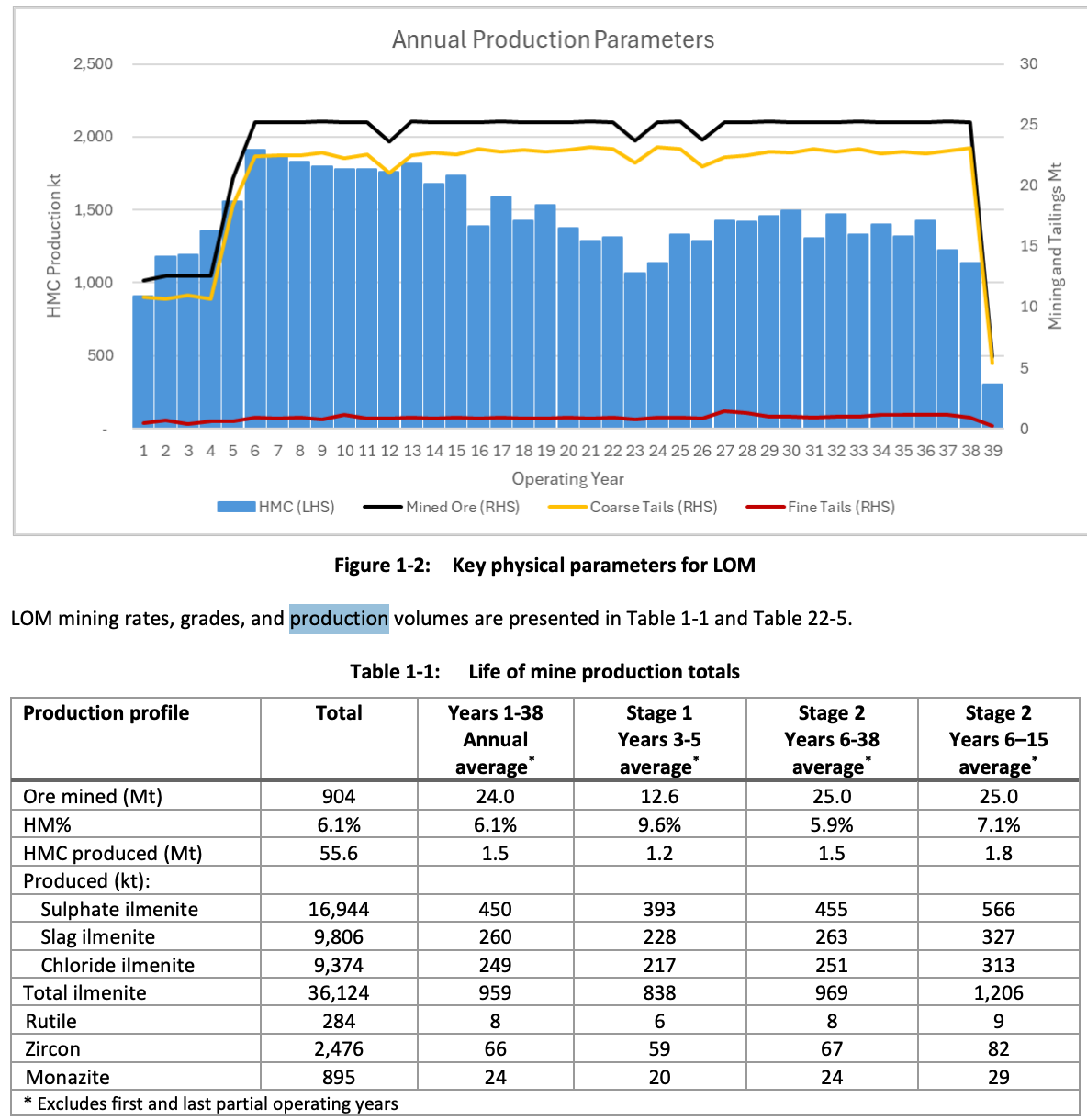

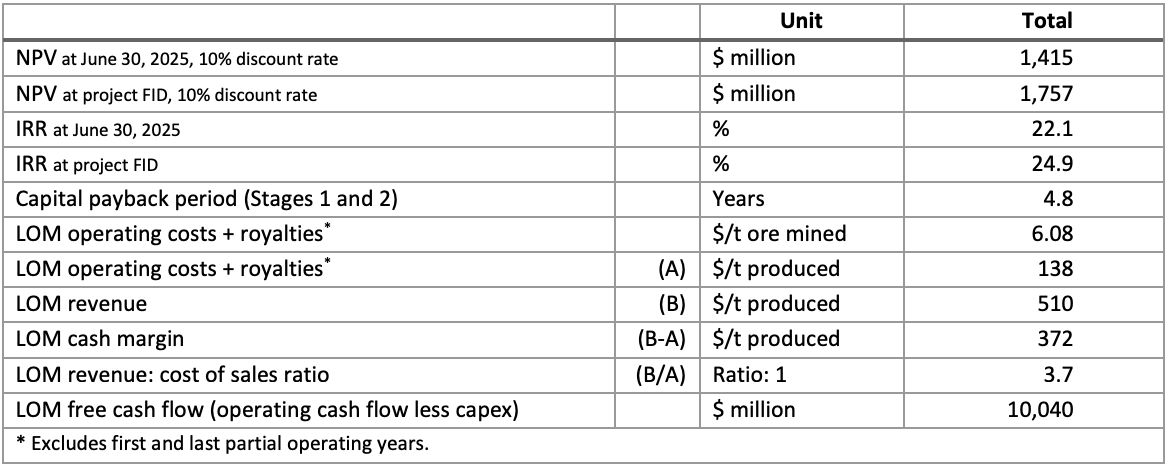

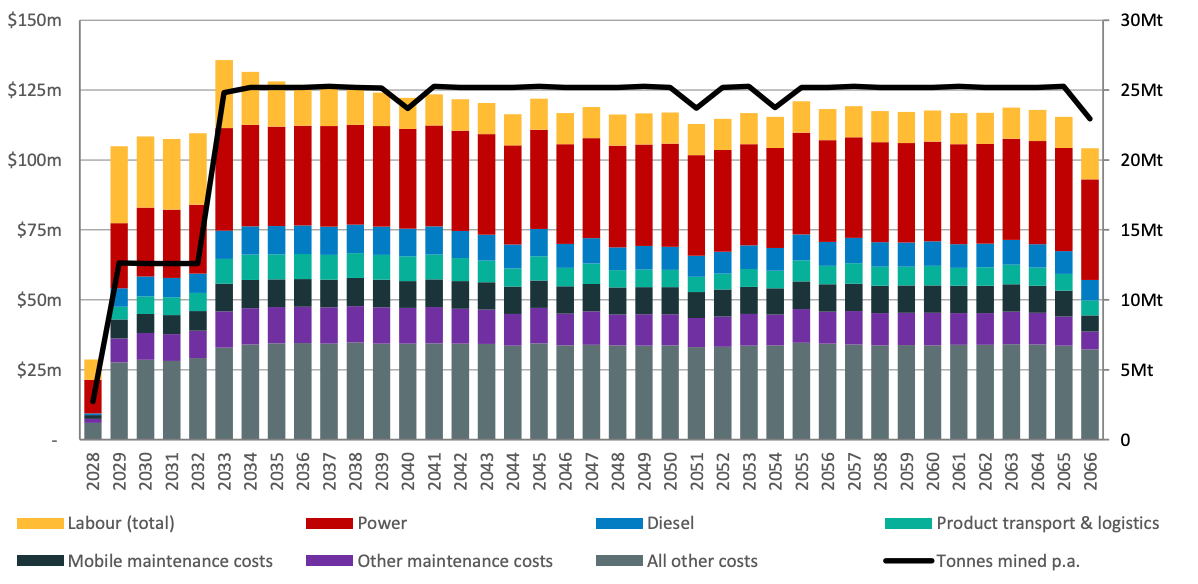

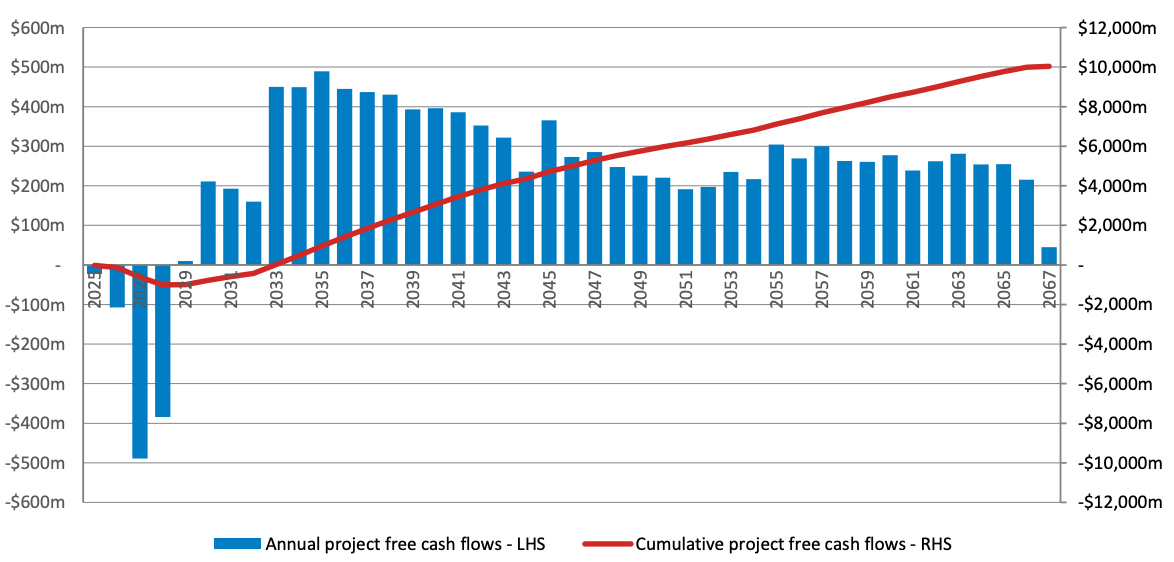

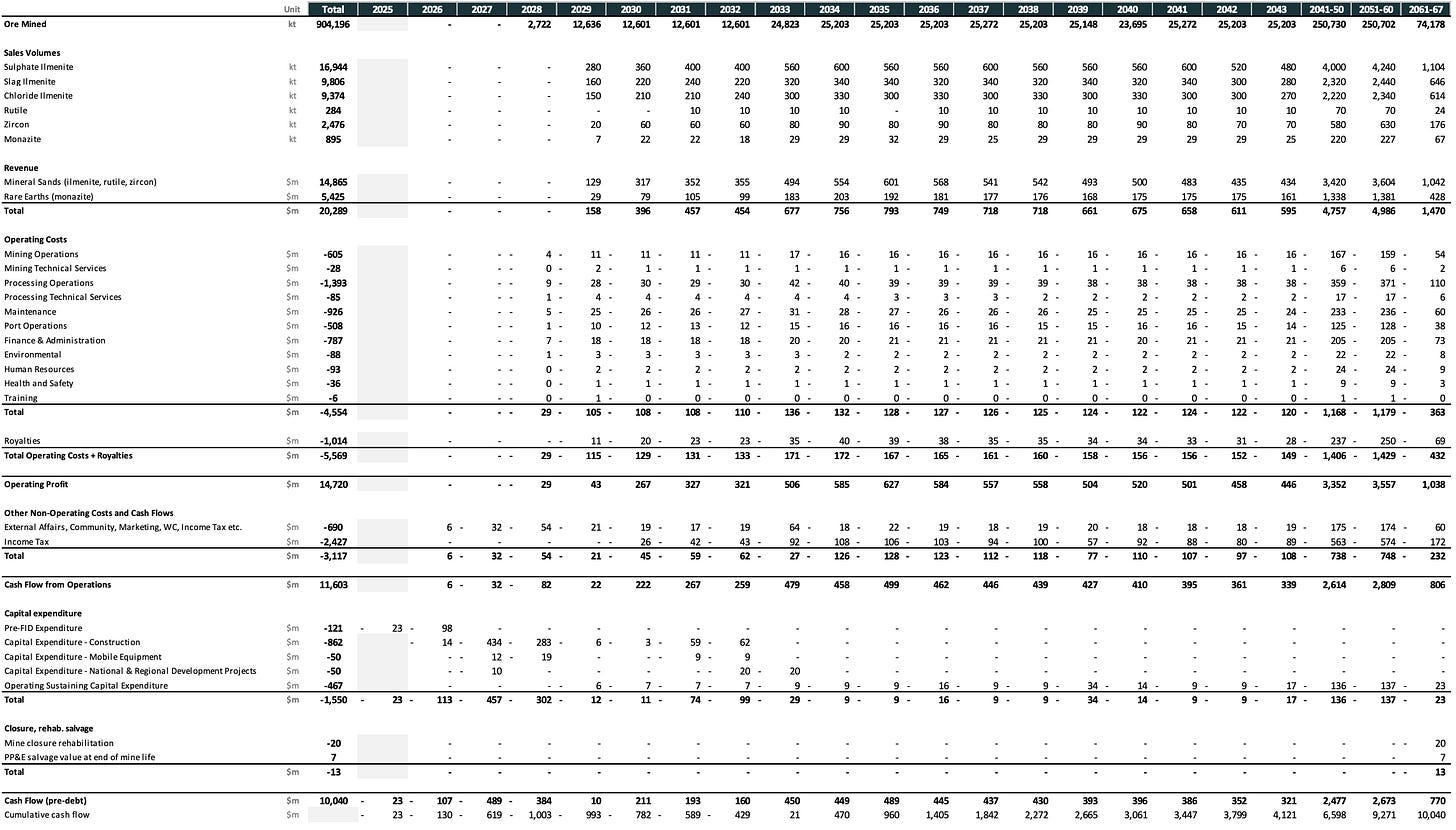

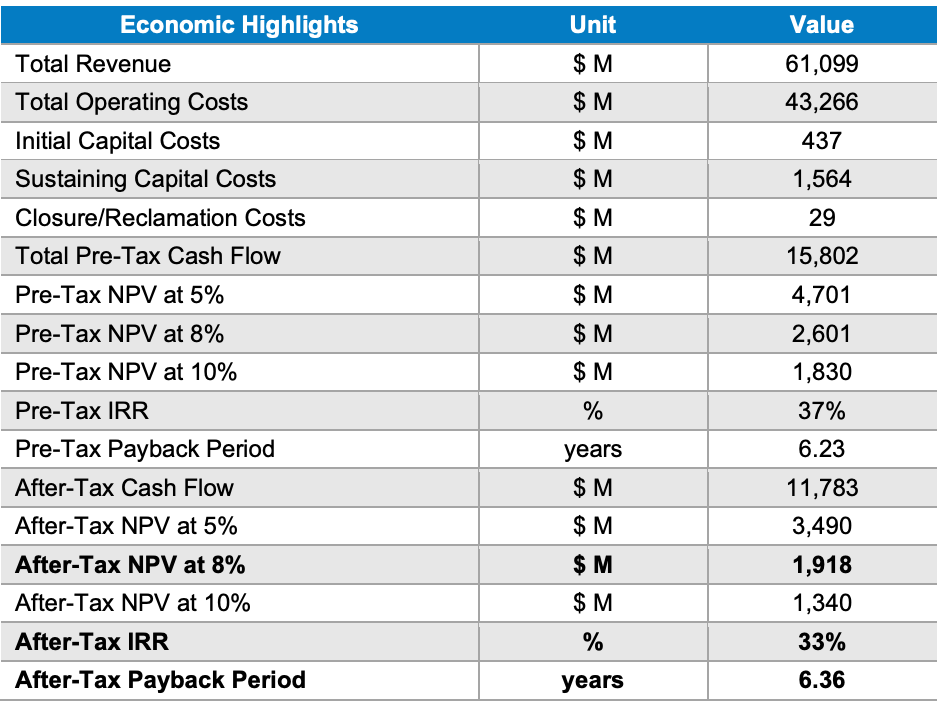

Toliara project boasts a massive $1.757B NPV10 at FID. IRR is at 24.9% and Capital payback period for both stages is 4.8 years. LOM free cash flow from the project exceeds $10 billion dollars.

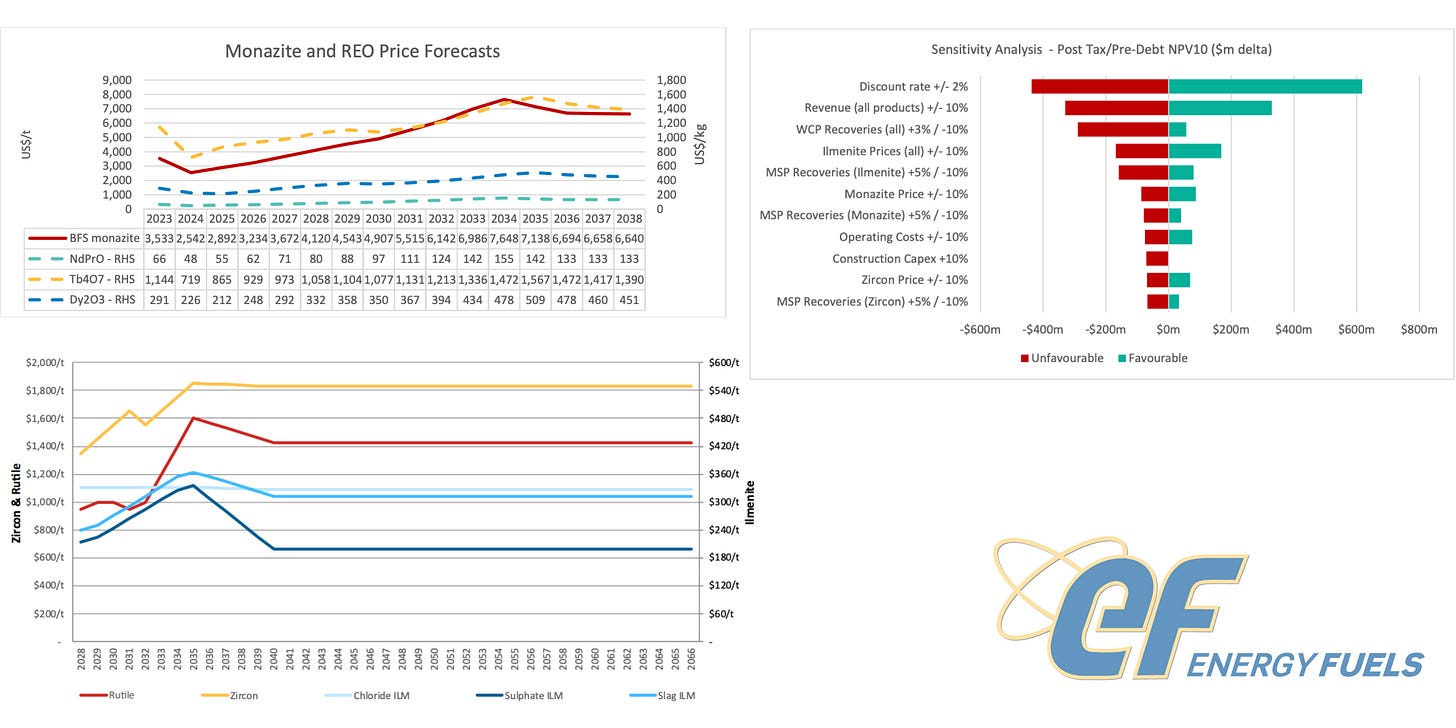

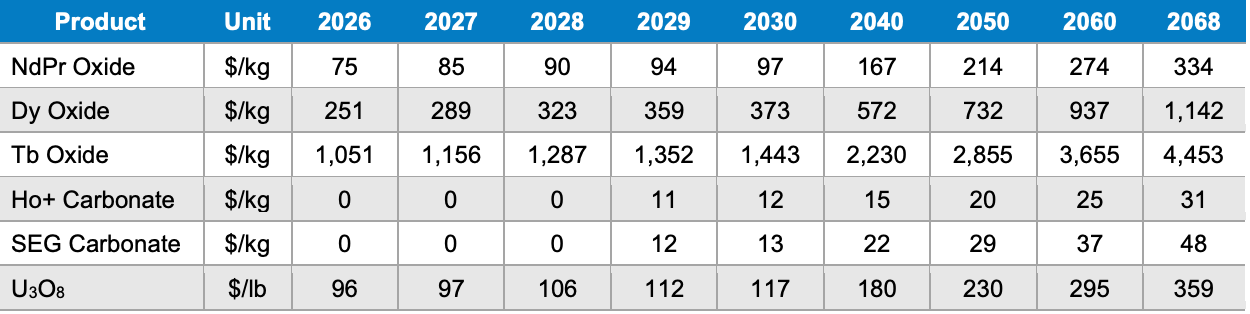

The prices used in Feasibility Study with Sensitive Analysis are as follows:

To get things going…

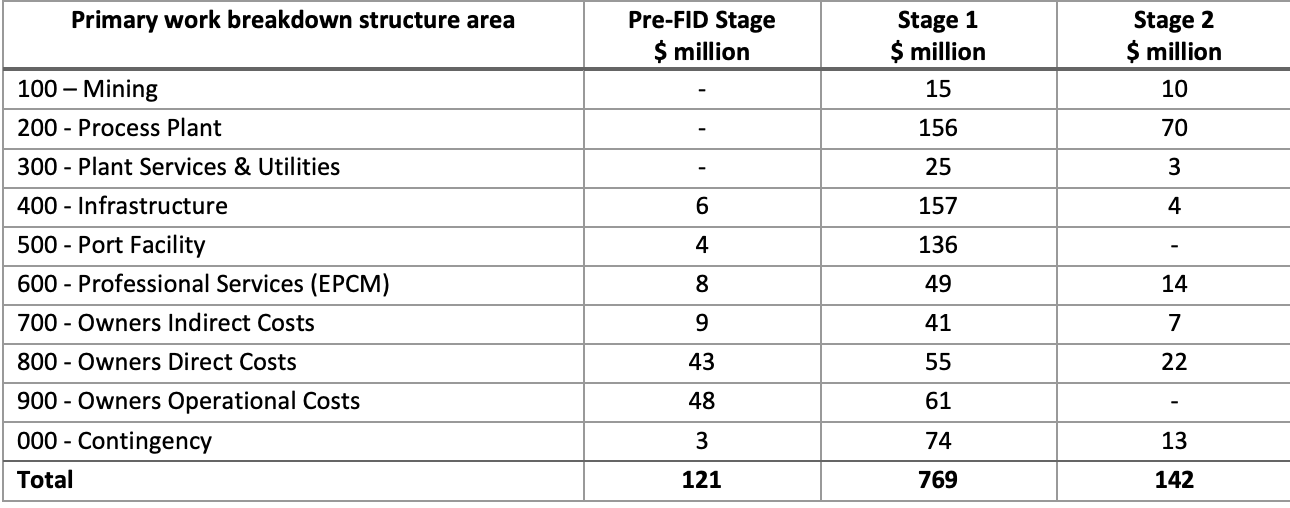

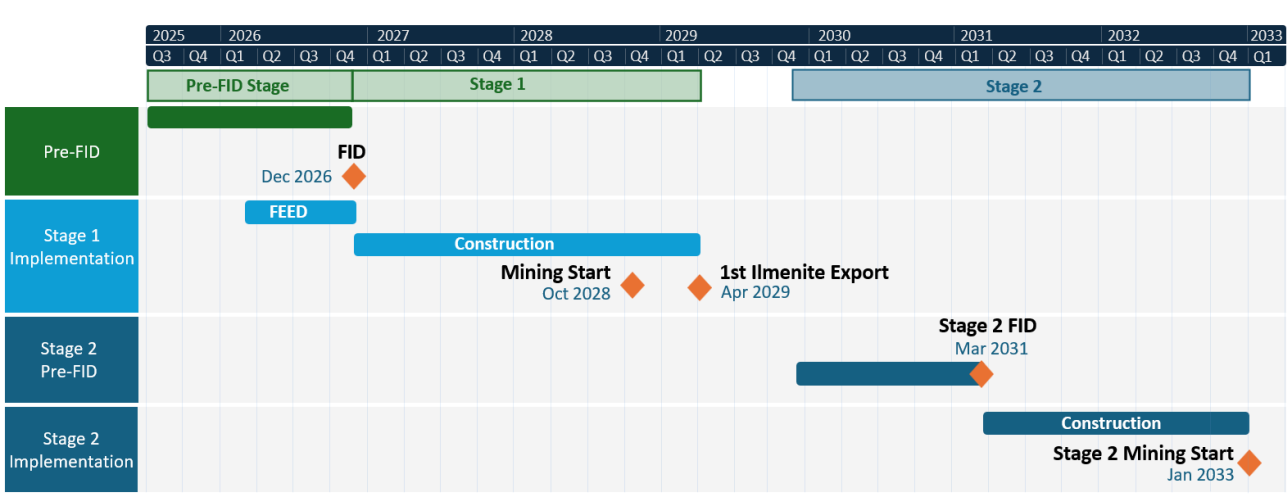

Pre-FID Stage: Includes the social, environmental, licensing, land acquisition and FEED (Front-end Engineering Design) activities required to ensure that the project is technically, financially and regulatorily sound. Prior to the final investment decision, the Pre-FID expenditure of $121 million is expected to be fully self-funded.

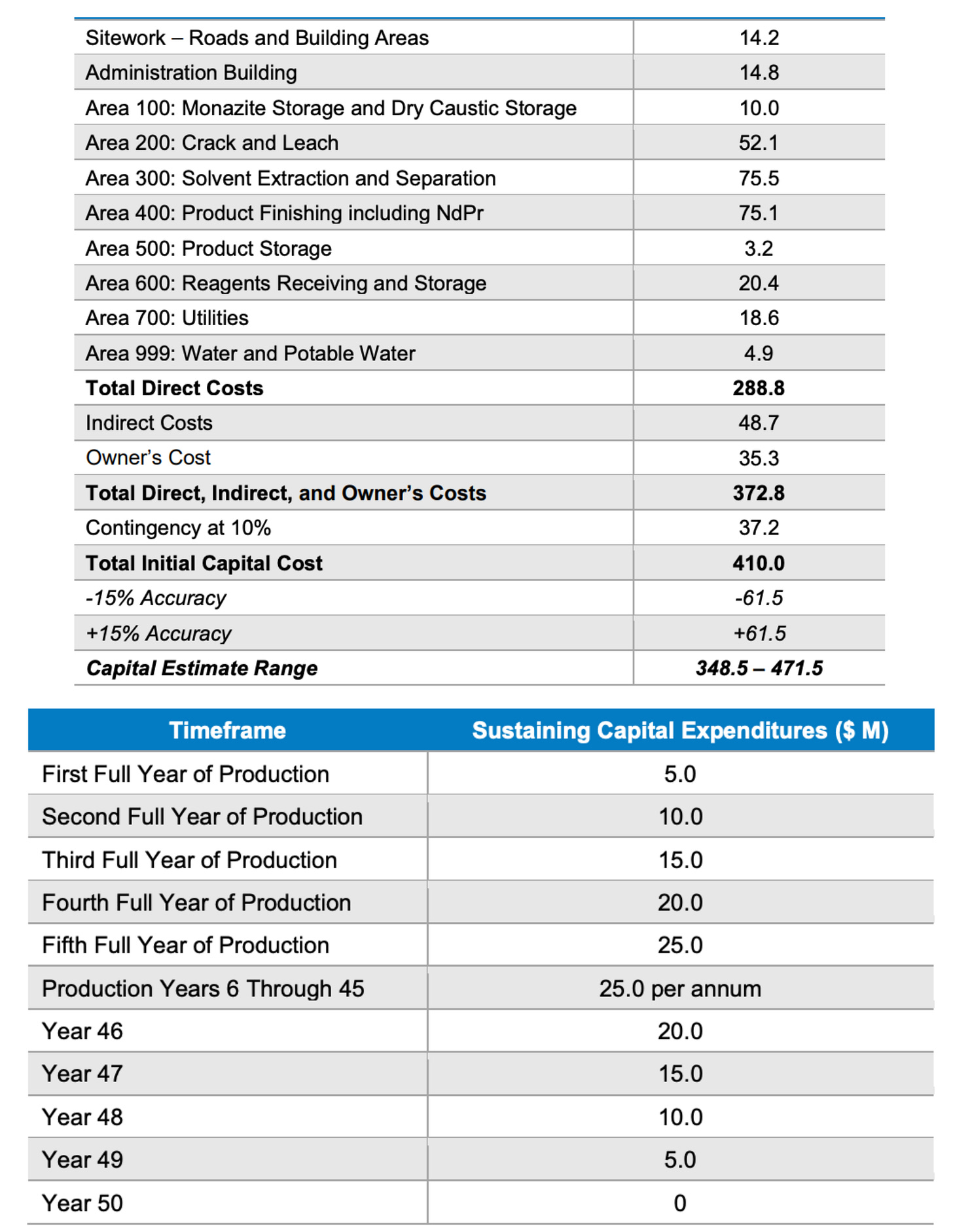

Stage 1 implementation capital is estimated at $769 million, which is included within the project funding plan and represents the capital necessary to achieve full Stage 1 commissioning. Stage 2 capital expenditure of $142 million is scheduled to be incurred over operating years three and four and is expected to be fully funded from the project’s operational cash flows.

Currently Energy Fuels expects to reach FID Q4/26. With 28 month construction period mining would start October 2028 and first Ilmenite export would into waterways April 2029.

Stage 1: 1,750 tph mining operation; 1.2 Mtpa production of HMC, 903 ktpa of product (ilmenite, rutile, and zircon) and 20 ktpa monazite • Stage 2: 3,500 tph mining operation; 1.8 Mtpa production of HMC, 1,297 ktpa of product (ilmenite, rutile, and zircon) and 29 ktpa monazite. With CAPEX of $142M, Stage 2 would significantly increase the production.

In the financial model, it is assumed that monazite is shipped to a port in the United States of America for delivery to the Company’s White Mesa Mill in lots of 200 containers (3,600 t) at a cost of $1.9 million per shipment or $531/t. There is an assumed two-month delay between revenue recognition/product shipping and revenue receipt for cash flow forecasting purposes. The project’s base case assumes dispatching 200 container shipments to ports in the United States of America, adhering to current legislative constraints for Class 7 (radioactive) cargo. It is anticipated that these constraints will be eased, allowing for approximately 500 container (10,000 t) loads to be shipped. The container yard is designed to accommodate anticipated future legislative changes regarding the import of Class 7 materials into the United States of America.

Quotes received for Class 7 ocean freight to western markets (USA or Europe) estimate the cost between US$1.75 million for a 100 container shipment and US$2.40 million for a 500 container shipment. The Monazite PFS assumes all shipments will be in 200 container lots at a cost of US$1.91 million per shipment, or US$531 per tonne. International freight costs are expected to be borne by Energy Fuels, not the end customers.

Marketing strategy and main target markets for Toliara project products

Securing offtake agreements with specific contract commitments required by lenders may only be acceptable to certain customers. Equally, debt providers may only be willing to accept such offtake contracts being secured with customers of a certain standard and/or within certain jurisdictions. It is intended that 100% of the monazite produced at the Toliara Project will be internally transferred to the Energy Fuels White Mesa REO facility in Utah, USA, under an offtake agreement. Ongoing discussions with debt finance advisors will continue to shape the marketing strategy for the Toliara Project as it moves towards FID. In addition, Energy Fuels may explore joint venture funding and US Government debt providers who may be willing to underwrite/guarantee the monazite offtake with White Mesa.

The monazite produced from the Toliara project will be processed and value added at the Company’s wholly owned White Mesa Mill located in Blanding, UT, the price of monazite paid by the Company to the Toliara project is shown as revenue to Base Toliara (a wholly owned subsidiary of Energy Fuels Inc.). The final products sold by Energy Fuels Inc. will be rare earth oxides and carbonates, namely NdPr, Tb and Dy oxides and SEG and Ho+ carbonates.

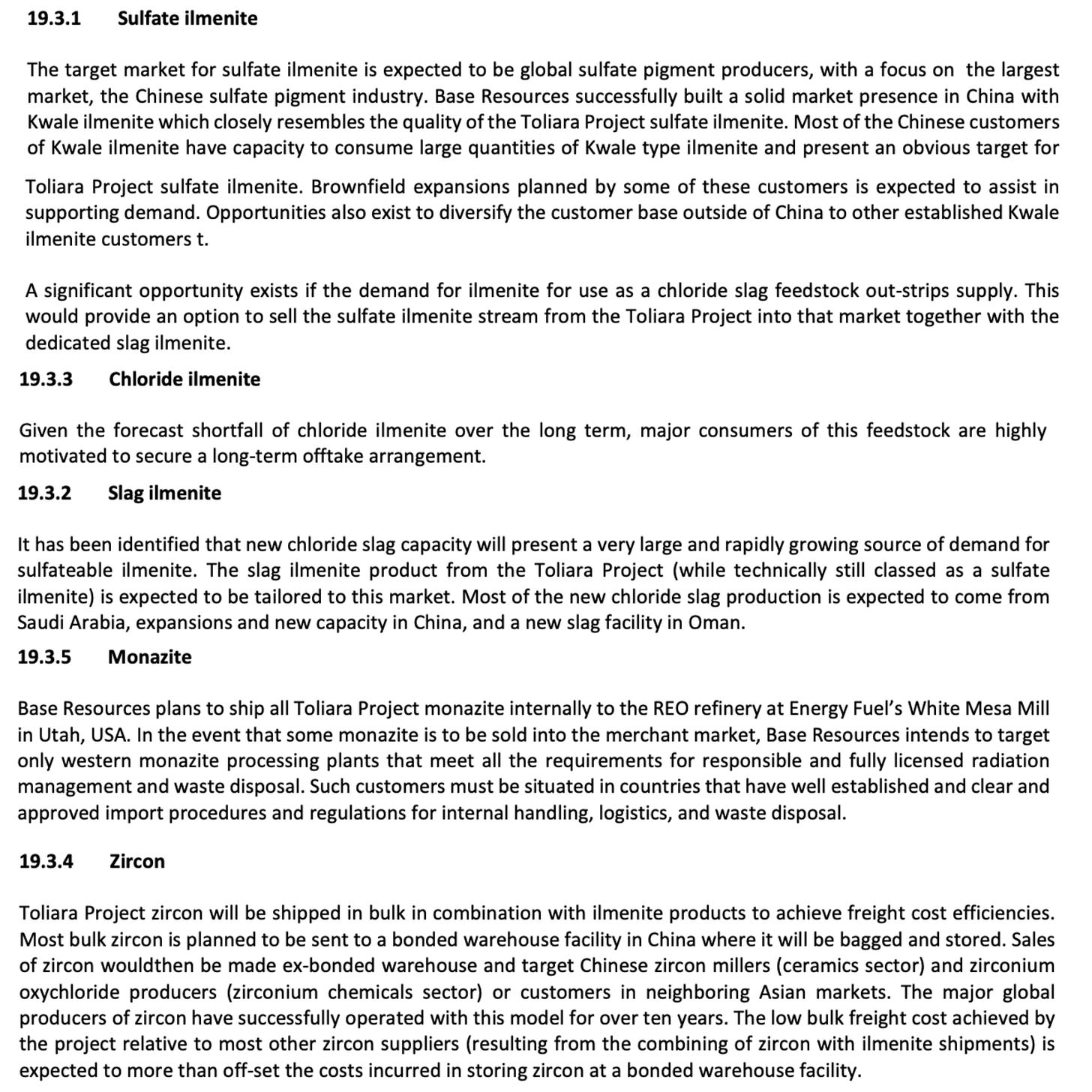

Additional market studies

Marketing samples of each grade of ilmenite have been reviewed by key customers. The specifications of all products are consistent with market requirements. The specification is generally regarded as an acceptable sulfate pigment feedstock. The Fe2O3 level is at the higher end of the range currently being consumed by Chinese sulfate pigment producers (approximately 7% to 25%), but is consistent with the levels in Kwale ilmenite (approximately 20%) supplied extensively to the Chinese market from 2014 to 2025.

Marketing samples closely resembling this specification were sent to key chloride slag producers for feedback. A number of major chloride slag producers have approved this specification and expressed a desire to enter major offtake agreements for Toliara slag ilmenite.

Marketing samples closely resembling this specification were sent to key chloride pigment and synthetic rutile producers for feedback. It has been confirmed by chloride pigment, synthetic rutile, and chloride slag producers that this product would meet their requirements.

This quality of zircon is regarded as a good standard grade zircon and is acceptable to all key end use sectors. The elevated levels of U+Th (above an industry benchmark of 500 ppm for premium zircon) are not expected to create any quality related concerns by end users but may restrict the geographic markets into which it can be sold without additional approvals. The specification meets all requirements for target customers in China and other key Asian markets. Customers who have received samples, including two large milling companies in China and a large fused zirconia producer in China, have expressed an interest in entering into a major offtake agreement for Toliara zircon.

Through the successful marketing of mineral sands products from its Kwale operation in Kenya, Base Resources has gained a strong reputation in the global mineral sands markets and established solid relationships with major consumers across the global TiO2 pigment, titanium metal, welding consumables, opacifier (milled zircon for ceramics), and zirconium chemicals industries. This market presence forms the foundation on which Energy Fuels will build a solid market position for its Toliara Project heavy mineral sands products. From a volume and traditional HMS perspective, the Toliara Project is regarded as an ilmenite project with a significant contribution from monazite and zircon as co-products. Base Resources successfully built a solid market presence in China with Kwale ilmenite which closely resembles the quality of the Toliara Project sulfate ilmenite. Most of the Chinese customers of Kwale ilmenite have capacity to consume large quantities of Kwale type ilmenite and present an obvious target for Toliara Project sulfate ilmenite.

Approximately 838 ktpa of combined ilmenite production is planned in the first three years of Stage 1 followed by 1,206 ktpa in the first ten years of Stage 2 production. Of this, approximately 621 ktpa is a slag and sulfate ilmenite growing to approximately 893 ktpa during the first ten years of Stage 2 production. The Toliara Project will also produce approximately 217 ktpa of chloride ilmenite growing to approximately 313 ktpa during the first ten years of Stage 2 production. This will be a new product for Base Toliara and allow the company to enter the niche chloride ilmenite market.

The zircon contribution from the Toliara Project will provide Energy Fuels with a significant presence in the high value zircon market. Approximately 59 ktpa of zircon will be produced from the Toliara Project during the first three full years of full production and this will increase to approximately 82 ktpa during the first ten years of Stage 2 production. The growing importance of REOs as critical minerals in western supply chains led Energy Fuels to develop its own REO supply chain strategy through the acquisition of Base Resources in 2024 in order to secure the future supply of monazite from the Toliara Project. It is intended that all monazite produced from the Toliara Project will be internally transferred to the Energy Fuels’ REO refinery being developed in Utah, USA. It is the rapid emergence of demand for permanent magnets in new green technologies, specifically electric vehicles and wind turbines, that has dramatically altered the REO landscape. Growth in demand for the REOs needed in permanent magnets, neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb), is expected to exceed supply and create a supply gap that the world will find challenging to close over the long term.

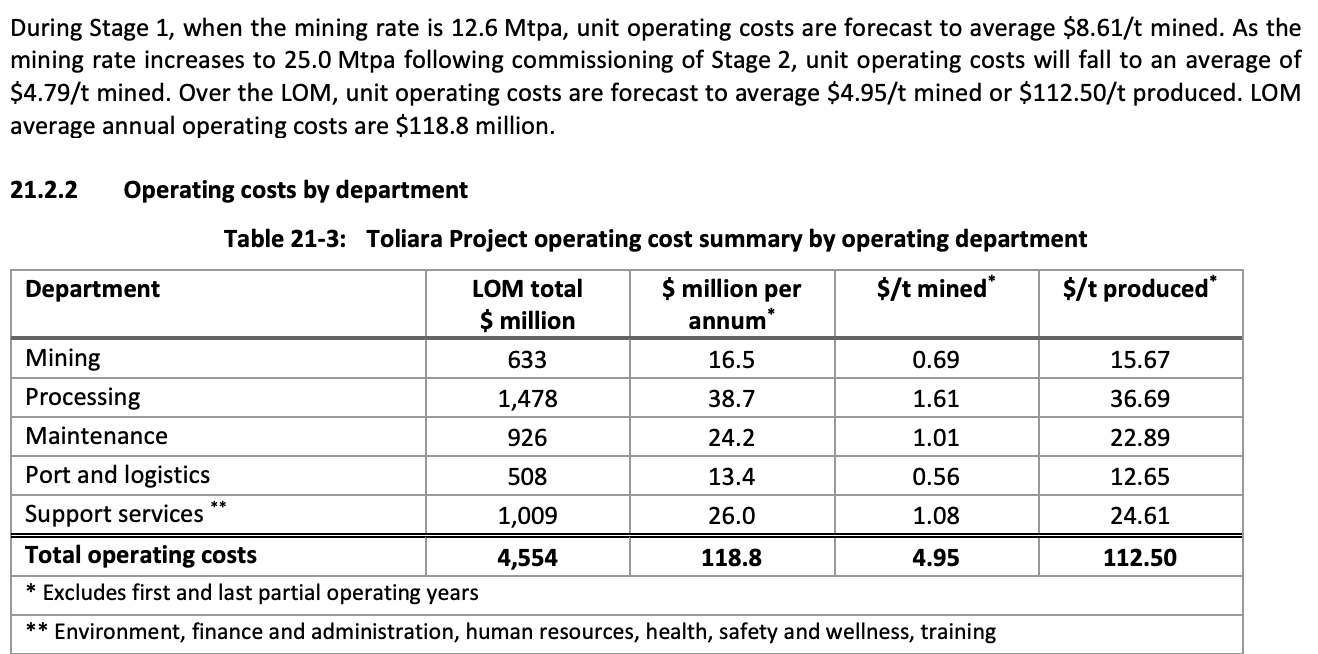

Costs overview

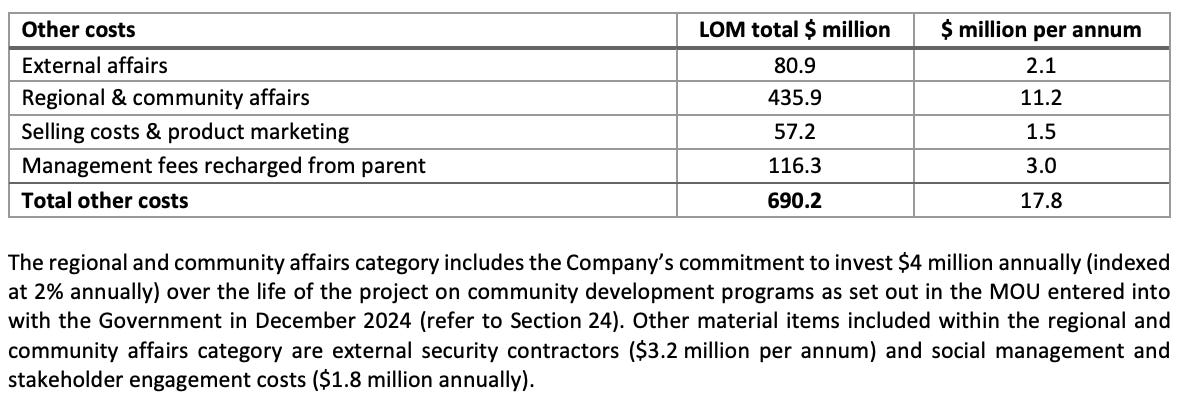

Mining operations account for 14% of operating costs with power, labor, and diesel primary contributors. Labor headcount increases from 298 personnel during Stage 1 to 568 personnel in Stage 2 operations. Heavy mobile equipment, including the primary mining fleet of D10 and D11 bulldozers, consume the majority of the Toliara Project department's diesel, with additional consumption from ancillary mobile equipment. Burn rates for all equipment are based on Kwale experience and operating hours are derived from a build-up of activity hours by equipment. Processing includes the WCP, MSP, and MCP and accounts for 32% of the projects total operating costs, making it the largest cost department. Power is responsible for approximately 70% of the department’s cost with pumps and, to a lesser extent the HMC hybrid dryer (using a combination of power and diesel), responsible for the majority of consumption. Diesel used in the hybrid dryers is also a significant cost, as is labor with 236 personnel during Stage 1, increasing to 314 personnel in Stage 2 operations. Diesel is forecast at a delivered price of $0.802/L based on the average from three vendors’ quotations.

Maintenance covers both fixed plant and heavy and ancillary mobile equipment and is responsible for 20% of total operating costs. Mobile equipment maintenance costs are based on a flat hourly rate applied to the forecast activity-based operating hours. Hourly rates are derived from the actual maintenance costs incurred over the life of each type of equipment at Kwale and averaged over their respective lifetime operating hours. With a large number of expatriate employees at the commencement of operations, labor is initially a significant cost; however, the number of expatriates quickly reduce over time as skills are transferred to Malagasy nationals. Labor headcount increases from 206 personnel during Stage 1 to 230 personnel in Stage 2. Port and logistics costs account for 11% of total operating costs and are dominated by transport and marine operating costs. Bulk transport of ilmenite (sulfate, slag, chloride), rutile, and zircon products, and containerized transport of monazite from the mine site to the export facility via a 45 km mineral haulage corridor are based on contractor quotations. Marine operations will be contracted to a specialist marine service provider, with the cost based on vendor quotations.

Project level cash-flow

Taxes, royalties and community development

In December 2024, Energy Fuels entered into an MOU with the Government, setting out certain key terms for the project. One of the key terms of the MOU is that Energy Fuels will deliver $80 million in development, community, and social project funding, as follows:

$30 million after achievement of LGIM* certification or similar stability mechanism

$10 million after achieving a positive FID

$20 million after the third anniversary of the effective operations start date (first commercial shipment)

$20 million after the fourth anniversary of the effective operations start date The development, community, and social project funding is treated as capital expenditure in the financial model.

*Law No 2001-031 on large-scale mining investments dated 8 October 2002 as amended by Law No 2005-022 dated 27 July 2005

Additionally, a contribution of 3% of the direct investment amount is required to the Mining Fund for Social and Community Investment.

The income tax rate applicable under the LGIM is 25%. The current prescribed company income tax under the General Tax Code is 20%. The LGIM affords the automatic right to benefit from more favorable provisions, therefore the lower rate of 20% will apply and has been adopted for the 2025 Feasibility Study. In addition, the General Tax Code provides for a rebate of corporate income taxes on capital investments undertaken (capital expenditure) from the commencement of operations equivalent to 25% of the capital expenditure in any given year, at the applicable corporate income tax rate. Any rebate in corporate income tax not used in a given year can be carried forward to future years until fully utilized. It is assumed this will apply to all sustaining, Stage 2 construction costs, and WCP relocation capital expenditure. The LGIM does not set a maximum royalty rate but defers to the New Mining Code (2024) which currently prescribes a royalty rate of 5% on the FOB (Free-on-Board) sales value.

The LGIM regime provides for customs duties and import tax exemption on materials, goods, and equipment imported by the Company or its subcontractors during the initial construction phase. Instead, those items attract a 1% customs stamp duty, which has been incorporated into the Stage 1 capital cost estimate. The LGIM regime also provides that during the operational phase all materials, goods, and equipment imported by the Company are subject to preferential combined customs duty and import tax at a rate of 5%. Customs stamp duty does not apply for the operational phase of the project.

In Madagascar, VAT is applicable on all in-country costs, both operating and capital, and reverse-VAT is applicable to imported services, materials, goods, and equipment. The VAT rate is currently 20%. The LGIM regime provides for VAT exemption on materials, goods, and equipment imported for the initial construction phase. The following conservative approach has been taken to VAT refunds for the project:

Stage 1 construction capital VAT: An estimated 50% of the Stage 1 construction capital costs and 100% of the heavy mobile equipment purchased in-country are forecast to be subject to VAT. This will result in $80 million of VAT being incurred over the Stage 1 construction period. The construction VAT has been conservatively assumed to be refunded 48 months after first shipment, in April 2033, as a lump sum.

Operational period VAT: An estimated 70% of all operational and capital costs after the completion of Stage 1 construction are subject to VAT and forecast to be refunded six months after being incurred.

6.1 Economics with White Mesa Mill

One week after Toliara/Vara Mada FS, Energy Fuels released a long awaited FS for White Mesa Mill Phase 2 operations. I decided to add those numbers in this article as well, because the facility is a critical part of Energy Fuels’ strategy. Unfortunately the bankable study is heavily redacted so we don’t have all the key metrics available and for that reason I’ll keep this part relatively simple. If you want to read the full study, its available here.

"Energy Fuels is on the cusp of solving America's rare earth processing 'bottleneck'," stated Mark S. Chalmers, CEO of Energy Fuels.

White Mesa Mill Phase 2 would add NdPr processing capacity to 6,000 tpa (tonnes per annum), and in heavies, the facility can process 240 tpa Dysprosium, and 66 tpa Terbium. That processing capability will cost Energy Fuels approximately $437M in initial capex to get things rolling. Phase 2 Circuit only is supposed to deliver $311 million of average annual EBITDA for first 15 years. Paired together with Toliara project they have the ability to generate approximately $765 million of EBITDA per year over the first 15 years for Energy Fuels shareholders.

All-in costs for up to 32,000 tpa from the Vara Mada Project alone (including transportation costs) equating to:

$29.39 per kg NdPr oxide equivalent.

All-in costs for 50,000 tpa monazite from all modeled sources including Vara Mada (including transportation costs) equating to:

$59.80 per kg NdPr oxide equivalent.

Economic highlights of the Phase 2 Facility are as follows; NPV8 $1.9B, After-Tax IRR 33%, After-Tax Cash Flow $11.7B. Paired together with Toliara the combined NPV is $3.7B.

Prices used in the study. All the prices have 2.5% annual escalation (so does the costs used in the study)

The reason behind this upgrade is relatively simple;

China has dominated both mine production of REE feedstock and processing of refined REE materials. It also controls downstream manufacturing markets, including the high-value magnet sector. Outside China, governments are actively supporting new production to create additional raw material supply chains for REPMs and to reduce reliance on Chinese output. Currently, the majority of NdPr oxide is refined in China. Due to increased geopolitical tensions between China and western jurisdictions and increased supply chain scrutiny, many manufacturers and tiered suppliers are actively pursuing supply options for REE oxides outside of China. The drive to expand and diversify supply chains has encouraged new non-Chinese downstream production and capacity. However, with many projects yet to reach feasibility stage and construction, and lead times remaining long, the demand for ex-China REEs, particularly NdPr, Dy, and Tb required for permanent magnets, is expected to remain high and grow considerably. Additional upside may be supported by government policy and regulatory settings, particularly in the European Union (EU) and the U.S., which are aimed at strengthening non-Chinese supply chains.

7. My remarks and opinion

In my opinion, this Feasibility Study confirms how excellent this project really is. Due the multiple studies the technical side of the deposit itself has been de-risked significantly, and Energy Fuels should have pretty damn good idea about how to approach the deposit and how to develop the most optimal mining plan. Additional LSU-zone drilling in 2026 could result in further upside, but even without adding any mineral reserves from LSU-zone, the numbers of the project look really good.

I think that the commodity prices Energy Fuels used in the FS, are not overly-optimistic, at least in monazite front. I have to admit, that I have some learning to do about the dynamics of Ilmenite, Zircon and Rutile markets. Products, that form 73% of the expected revenue of the project. One extremely good thing is that the design of the MSP allows the ratio of the three ilmenite products to be varied to suit the market conditions and take advantage of market opportunities as they arise. Goes without saying, that this significantly de-risks the market risk about individual ilmenite products.

Now, although the numbers look great and the technical risk is reduced as much as possible, getting this monster into a production is not a walk in a park, especially on time and budget. Immense amount of infrastructure have to be built not only to the mine site, but around the region as well. And remember the key aspect, the skills required for operations are not currently available in the region, so most of the workforce need to exported from other parts of Madagascar.

Additionally, Energy Fuels still need to reach some land agreements with the locals, and of course secure Investment Support Regime with the newly elected Malagasy government, that will add monazite to the exploiting permit.

I think that the NPV10 ($1,757B), or even NPV12 ($1,389B) is currently well justified given the complex road to production. However, as more questions gets answered and major hurdles like the monazite permit, land extension and most of the critical infrastructure has been solved, NPV8 should be reasonable. I personally like to value all projects at NPV10 but market might start to lower the discount rate as this gets closer to production.

At production

When in production, there is always the Africa risk; Madagascar is one of the most poorest countries in the world and poverty rate in Toliara region is currently 75%. That automatically means more socio-economic risk. Government instability, resource nationalism, expropriation and changes in law or interpretations of the law are all factors that you cannot rule out. Remember, this country had a Coup d’etat three months ago and if the new government doesn’t deliver, it can happen again at any moment.

If Madagascar plays ball, the next big risk is market related. This is huge, world-scale Ilmenite project, that will absolutely flood the market at Stage 2 production. Biggest market for Ilmenite products is of course China, and its interesting to see how Energy Fuels is going to navigate the waters, especially if the company signs off-take agreements with USG, get loans from USG entities or gets granted a price-floor for the monazite-related products coming out of the mine. Will US Government help the project economically in any way, if decent part of the production is going to China?

One possible Western buyer for Toliara’s Ilmenite products is Chemours, which is already partnering with Energy Fuels. Chemours is a spin-off from a massive United States based chemical company Dupont de Nemours. Chemours is actively importing Ilmenite Sand from Rio Tinto’s project in Madagascar.

In the shipping front, there is some upside to be unlocked, if the receiving port at United States will eventually approve 500 container shipments. A 500 container shipment costs only 25% more than 200 containers, so it is a no-brainer move if the US local legislation will allow it when the project comes online.

Shipping costs from Madagascar to White Mesa Mill are massive part of the project, and Energy Fuels need to nail and optimise that to perfection so the margins doesn’t die out. Right now the estimated cost in the study is $531/t ($1.9 million per shipment), but I can assure you that there numbers can easily get out of hand.

If you want to read more about the shipping procedure in detail, make sure to check this wonderful thread put together by Piotr. This is top-notch work (And remember, it was done way before we had these recent studies available), so go give Piotr a follow.

I think this is all for now. If you are still here, there is probably something seriously wrong with you. Or you are just a rare phenomenon who actually wants to know something about the companies they own.

But any way, thanks for reading.

Incredible breakdown. The infrastructure buildout is honestly the biggestconcern for me here, not the geology. I worked on a project in sub-Saharan Africa years back and the timeline and budget overruns were brutal when local skills weren't available. That $531/t monazite shippng cost to White Mesa feels like it could blow out if container logistics get messy dunno how they hedge that.

Fascinating deep dive into the Toliara project. The infrastructure challenges you highlighted are indeed critical - moving minerals from one of the world's most remote locations requires significant capital investment. The Madagascar rare earth potential is substantial, but execution risk remains high given the political and logistical complexities. Appreciate the detailed breakdown of the feasibility study.